Eaton Vance provides advanced investing to forward-thinking investors, applying discipline and long-term perspective to the management of client portfolios.

Worries over a More Hawkish Fed and Regulatory Tightening in China Spark 3Q EM losses

By: Emerging Markets Team

Article published on: October 12, 2021

Boston - Emerging markets (EM) debt followed a very strong second quarter, with a general sell-off during the third quarter, albeit with differentiation across segments. Concerns about the Delta variant of COVID-19, regulatory crackdowns in China and a more hawkish U.S Federal Reserve than anticipated all contributed to weigh on investor sentiment.

Commodity performance was mixed. Energy prices were boosted thanks to supply chain disruptions and weather in both Europe and China, while much of the metals complex was weaker, with concerns over the property sector in China.

Inflationary pressures remain elevated in most EM countries, as was the case in much of the world. Perhaps in contrast to most developed market (DM) central banks, many EM central banks have been reacting with more orthodox monetary policy. This combination has led to relatively steep yield curves in many countries and also provided additional support to currencies.

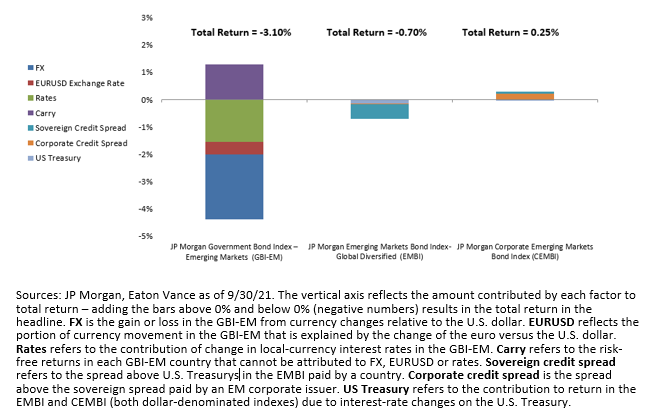

- EM local-currency debt lost 3.10%, mostly driven by the prospect of rising U.S. interest rates and concern over the China/Evergrande situation.

- Dollar-denominated, hard-currency debt dropped a modest 0.70%, as U.S. Treasury yields rose and sovereign credit spreads widened late in the quarter.

- Corporate EM debt eked out a 0.25% gain, as the average spread tightened further during the quarter within the corporate segment, despite notable widening in China. However, the rise in U.S. Treasury yields weighed on performance.

Corporate Debt Was Best in a Tough Quarter for EM Sector

A Look Ahead

As we head toward the end of the year, we are cautiously optimistic on the asset class, given that the balance of fundamentals and valuations appears reasonable.

EM fundamentals are broadly solid, as the global economy continues to expand, albeit at a slower rate of growth than earlier in the year. Primary risks stem from COVID-19, Evergrande/China and the pace of "tapering" chosen by the Fed. Fiscal balances are also a concern in many spots. However, we feel that markets are pricing these risks appropriately and valuations generally appear fair.

As noted, inflationary pressures continue, and we are closely watching the effectiveness of monetary policies implemented by many EM central banks.

Bottom line: We believe the case for active management of EM debt portfolios through careful due diligence of individual issuers is stronger than ever, as markets increasingly differentiate among countries and credits. This is especially true as the world continues to grapple with the challenges of recovery from the COVID-19 pandemic.

Loading PDF