Navigating Global Shifts – Views From Our Global Equity Team

U.S. equities have outperformed non-U.S. equities over the past decade, but our global equity team believes several factors are making non-U.S. markets more attractive, including lower valuation, less concentrated opportunity set, and country-specific factors (such as corporate reforms in Japan and the easing of Europe’s energy crisis). Below are some insights from our global equity team.

Dissecting U.S. Outperformance

There are three drivers of U.S. equity outperformance over the past decade. First, lower interest rates in the United States have bolstered the expansion of multiples. Second, U.S. companies have experienced higher earnings growth, driven primarily by stronger nominal gross domestic product (GDP) growth in the United States than other regions, most notably Europe. Third, in the past year alone, U.S. companies have repurchased an amount equivalent to 10% of the European equity market, which has boosted earnings per share growth and further contributes to their outperformance, amplified further by expanding multiples.

Why would that be about to change?

Inflation Is Cooling Faster Outside the United States

First, outside the United States, inflation rates are generally lower and government deficits are significantly smaller. In contrast, the United States exhibits a mix of restrictive policies and expansive fiscal measures, contributing to its unique economic environment. This scenario of lower inflation and interest rates abroad supports higher multiples for non-U.S. equities.

U.S. Equity Market Performance Is Concentrated

Second, U.S. equity market outperformance is partly due to concentration. The top 10% of companies account for 80% of cash-flow profits and 70% of market capitalization, a phenomenon not mirrored to such an extent elsewhere.

But when looking at U.S. companies in the top quartile of sustainable value creation (SVC) , our global equity team’s measure of quality, the picture is markedly different when excluding the largest companies. And historical shifts in the ranks of the largest companies suggest that today’s dominant players may not maintain their positions indefinitely.

In addition, while non-U.S. markets may not have giants like NVIDIA, Microsoft, Meta, or Google, they boast leading companies such as Novo Nordisk and Taiwan Semiconductor Manufacturing Company, and some of the best banks and consumer brands in the world in our global equity team’s view.

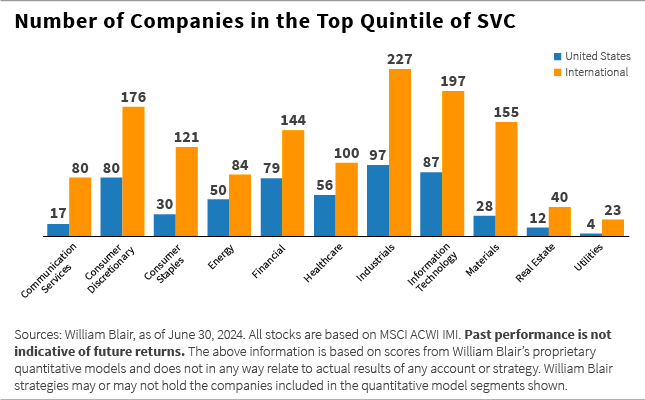

So, our global equity team believes that there are numerous thematic growth opportunities outside the United States, and the chart below supports that.

Changing Trade Flows Could Benefit Non-U.S. Equities

It’s also worth mentioning the evolving dynamics of global trade flows. Exports from emerging markets (EMs) to other EMs account for about 45% of total exports—much higher than it was a decade ago. More specifically, China’s share of exports to Group of Seven (G7) countries is decreasing sharply, while its exports to non-G7 countries, particularly in the global south, are rising significantly.

Why is this happening?

First, countries are increasingly trading with those that are geographically closer and more like-minded.

Second, foreign direct investment (FDI) in China has plummeted to virtually zero due to geopolitical tensions, a tightening regulatory environment, an economic slowdown, and shifts in global supply chains to mitigate risks highlighted by the COVID-19 pandemic.

Countries such as Vietnam are capturing market share in manufactured goods from China.

Third, countries such as Vietnam are capturing market share in manufactured goods from China, which is becoming more expensive. These countries offer cheaper alternatives and are often viewed as friendlier trade partners.

Fourth, the conflict between Russia and Ukraine has altered energy trade routes. Less Russian energy is flowing westward, while more is directed eastward, benefiting countries such as India.

Lastly, countries such as Brazil, Indonesia, and India have seen substantial growth, affecting trade volumes and patterns.

Japanese Corporate Reforms Are Taking Hold

Then there are some country-specific factors that make non-U.S. equities attractive. Let’s start by turning our gaze eastward to Japan, where the landscape is transforming.

As global equity team member Kyle Concannon noted in another blog post , Japanese corporate reforms—mandated by Tokyo Stock Exchange in collaboration with the government—are substantial. Second, a generational cultural shift in capital allocation is underway, prioritizing shareholder interests and increased capital expenditures. Third, Japanese constitutional amendments driving military expansion are increasing capital expenditures.

Europe’s Energy Crisis Is Easing

Next, in Europe, the initial severe impact of the energy crisis following Russia’s invasion of Ukraine has softened. Changes in energy supply dynamics have led to lower gas prices, diminishing the competitive disadvantages previously faced by European manufacturers compared to their global counterparts.

India Is Redefining Itself

Lastly, India has emerged from the shadows of China’s economic influence over the last two decades and has reached an economic tipping point, leading our global equity team to believe it is poised to redefine its role on the global stage. Several factors are contributing to this success.

Bureaucratic reforms under Narendra Modi’s governance have simplified business operations in India, fostering a more favorable environment for economic activities. The overhaul of the monetary system, primarily through digitalization, has increased transparency and efficiency in a traditionally cash-heavy economy. In addition, rising capital expenditure from both the government and private sector is driving infrastructure and development projects across the country.

India stands on its own two feet in ways it couldn’t a decade ago.

As GDP per capita rises, consumption patterns in India are shifting from basic needs to aspirational goods, reflecting the growing middle class’s increasing purchasing power. Geopolitically, India maintains a neutral stance, strategically leveraging its relationships. It is not a close ally of China but benefits from its ties with Russia to secure energy supplies, often paying in rupees instead of dollars. This approach reduces India’s external dollar dependency and allows it to re-export energy to Europe.

Moreover, about 80% of globally traded options contracts were executed in India last year, underscoring significant price discovery within the country. However, the high valuation of Indian consumer stocks, which often trade at 60 to 70 times earnings, exerts pressure on Indian banks as investors shift their funds from banks to equity markets.

India’s economic transformation is notable. It now stands on its own two feet in ways it couldn’t a decade ago, presenting an optimistic outlook for its role in international trade.

Non-U.S. Equity Valuations Are Attractive

These qualitative reasons for considering non-U.S. investments are now reinforced by our global equity team’s quantitative models, which indicate that the valuation attractiveness has shifted in favor of non-U.S. markets, a reversal from a long-standing trend.

Opportunities for Active Managers

Considering these dynamics, our global equity team believes the potential for non-U.S. equities to outperform is compelling—particularly for active managers.

Want more insights on the economy and investment landscape? Subscribe to our blog .

The post Navigating Global Shifts – Views From Our Global Equity Team appeared first on William Blair .