ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

GBPJPY: Buying The Dips at the Blue Box Area

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPJPY Forex pair , published in members area of the website. As our members know, GBPJPY has recently given us daily correction. The pair reached our target zone and found buyers right at the Equal Legs zone ( Blue Box Area) . In further text we’re going to explain the Elliott Wave pattern and trading setup.

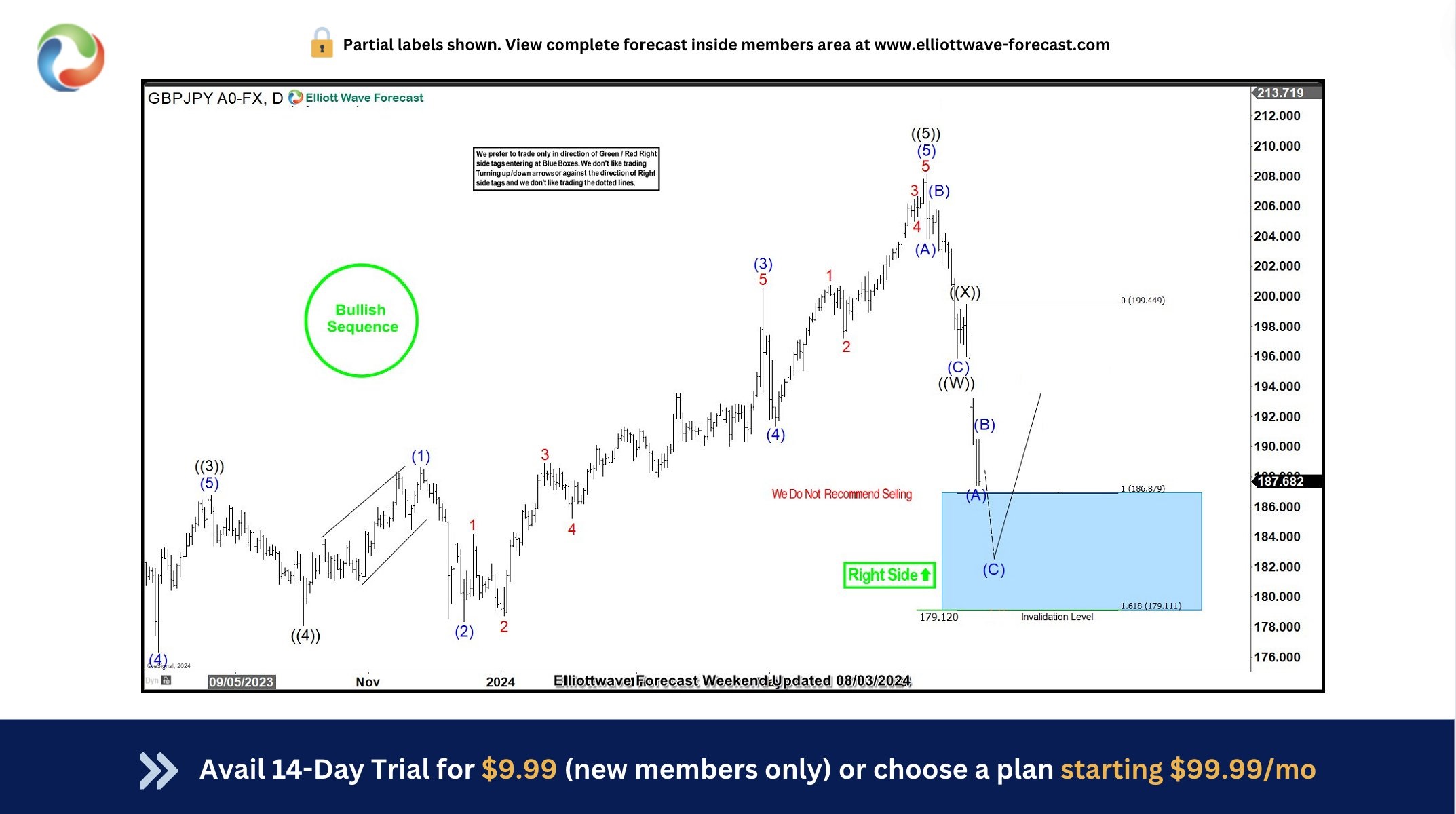

GBPJPY Daily Update 08.03.2024

The pair is giving a daily correction, which is forming as a Elliott Wave Double Three pattern. The pull back looks incomplete at the moment. Our analysis forecasts more short term weakness in GBPJPY toward the 186.879-179.111 area ( blue box).

Despite the expected extension lower, we advise against selling GBPJPY against the main bullish trend. Once the pair reaches this blue box area, we expect it to attract buyers. We can see either rally towards new highs or a corrective bounce in three waves at least. Once the bounce reaches the 50% Fibonacci retracement level against the connector high -((X)) black, we’ll secure our position by moving the stop-loss to breakeven. To safeguard our trade, we’ll closely monitor for any break below the marked invalidation level :179.111 .

A quick reminder:

Our charts are designed for simplicity and ease of trading:

- Red bearish stamp + blue box = Selling Setup

- Green bullish stamp + blue box = Buying Setup

- Charts with Black stamps are deemed non-tradable. 🚫

Reminder : You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page .

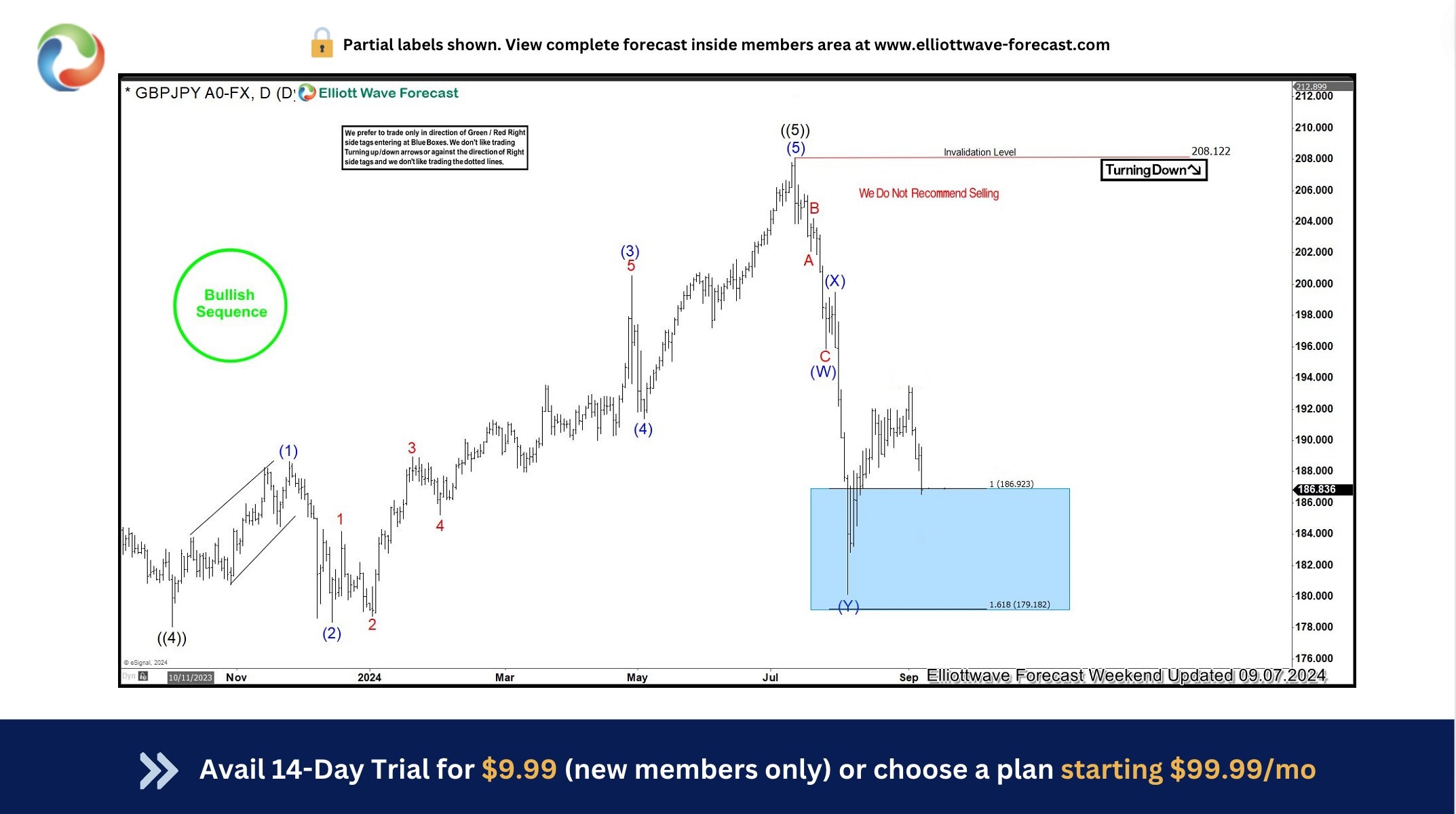

GBPJPY Daily Update 08.03.2024

The pair found buyers within the Blue Box area as expected. We got a nice rally from our buying zone. The bounce has exceeded the 50% Fibonacci retracement level against the connector peak. As a result, traders who entered long positions are now enjoying risk-free profits. With the price holding above the 180.32 low, we expect to see more strength in another leg up against the 208.12 peak at least.

Please bear in mind that the market is constantly evolving. The outlook presented here may have shifted since. For the latest updates, refer to the most recent charts available in our membership area. We focus on trading instruments with incomplete bullish or bearish swing sequences. The Live Trading Room highlights the best opportunities in real-time.

Source: https://elliottwave-forecast.com/trading/gbpjpy-buying-blue-box/