Official Franklin Templeton Investments account. For US investors only.

Tax policy takes center stage: What to watch on Capitol Hill

With the expiration of most individual tax provisions, brackets, and rates scheduled at the end of the year, deliberations on Capitol Hill are in full swing as lawmakers consider proposals for the future of tax rates.

The cost of extending the Tax Cuts and Jobs Act (TCJA) for 10 years exceeds $4 trillion, according to Congressional Budget Office (CBO) estimates. Last week the House narrowly passed a budget resolution in a key step toward drafting actual tax legislation. (See details about the resolution and extension of the TCJA in the Ways and Means release ).

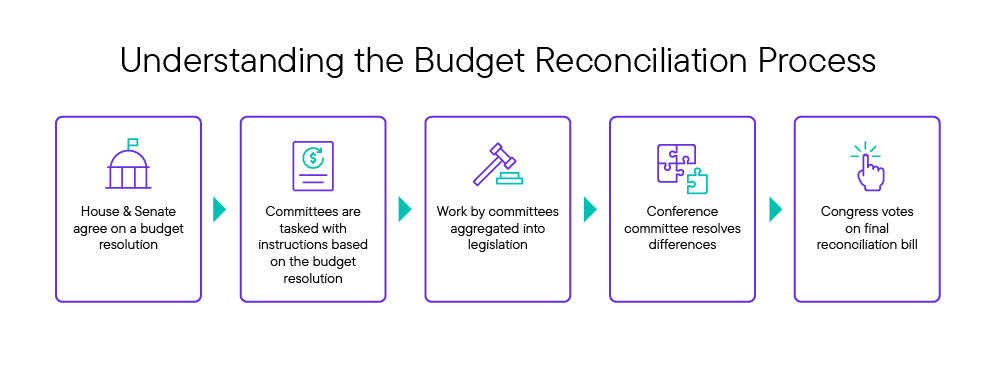

In recent weeks, the Senate passed a scaled-back budget resolution addressing funding around immigration and energy. The House and Senate actions are part of a broader effort, referred to as budget reconciliation. In this process, Congress can pass fiscal-related legislation requiring only a simple majority in the Senate. This paves the way to advance tax legislation with only Republican votes.

For more details on budget reconciliation see the Congressional Research Service’s educational piece, “The Budget Reconciliation Process: Timing of Legislative Action.”

As a next step, the Republicans from the House and Senate will need to agree on a combined plan to move the process forward. This will provide a framework for tax-writing committees in Congress to draft legislation.

For more information on the expiring TCJA, see “Looking ahead to the expiration of the TCJA.”

Here are three key areas we’re watching:

Will the “one big bill” plan move forward?

The House plan contemplates one comprehensive bill that would combine tax provisions with funding for immigration and energy-related initiatives. Republicans in the Senate have been less enthusiastic about a one-bill approach, fearing that working through all the details on the tax portion would delay funding for border needs, for example. Instead, Republican leadership in the Senate have called for moving quickly on immigration and energy items, while providing more time to tackle tax proposals later in the year. House Republicans are concerned that executing two budget reconciliation bills this year (one for immigration/energy and one for taxes) would be a steep hurdle.

Will there be relief on SALT?

This is one of the most contentious issues related to extending the TCJA. Given the ultra-slim Republican majority in the House, every vote is critical. There are approximately 20 Republicans in the House from higher-taxed states like CA, IL, NJ, and NY. Many of their constituents are clamoring for relief on the $10,000 cap for deducting state and local taxes (SALT). For example, there has been some discussion on doubling the cap for married couples or raising the cap to $15,000 for individuals and $30,000 for married couples. To what extent will House Republicans from those states tie their final vote to achieving some movement on the SALT cap? Of course, any relief on SALT would add cost to an already expensive price tag to extend the TCJA which may further complicate the broader process.

Planning note: If the SALT cap is raised for 2026, taxpayers may want to consider lumping deductions into next year to take advantage of a higher cap. For example (depending on personal circumstances), a taxpayer could claim the standard deduction this year, defer charitable contributions into next year, and itemize deductions in 2026 given the potential opportunity to deduct a higher amount of state and local taxes.

What tax provisions may be added?

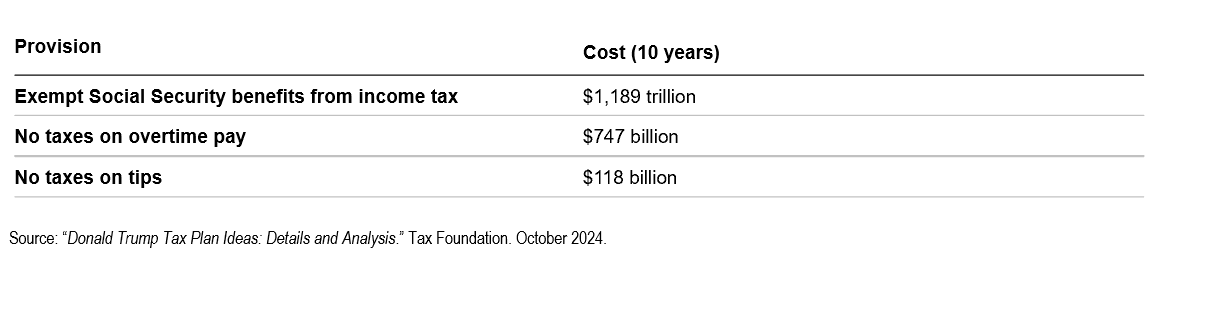

On the campaign trail last fall there were a number of tax-related proposals floated that are outside the scope of extending the TCJA. What are the chances that any of these items are included in a final tax package? Adding additional tax relief would further complicate the goal of extending the current provisions of the TCJA.

Here are three proposals that have been mentioned and the estimated cost:

Given cost constraints, providing some type of tax relief on tips may be more likely of any of these items to make it to the final tax bill. Certain limitations based on income levels could be implemented to reduce the cost (i.e. income phaseouts at certain levels).

Planning beyond the current landscape

While many households may avoid a higher tax bill next year if there is a final agreement to extend the TCJA, the longer-term outlook on taxes is unclear. For this fiscal year, the CBO estimates a deficit of $1.9 trillion. This marks the sixth consecutive year the federal budget deficit has exceeded $1 trillion. As part of longer-term planning, taxpayers should consider these factors as well as their own personal circumstances to explore options that may help hedge the risk of higher taxes in the future. For example, a series of partial Roth conversions at more favorable tax brackets could provide a source of tax-free income in the future.

Seek advice

When considering making adjustments to your plan, it’s important to consult a qualified tax or legal professional and your financial advisor. Personal circumstances vary widely, so it is critical to work with a professional who has knowledge of your specific goals and situation.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Copyright © 2024 Franklin Templeton. All rights reserved.

Ref. 4062958

The post Tax policy takes center stage: What to watch on Capitol Hill appeared first on Beyond Bulls and Bears .