We help investors, asset managers, and brokers succeed in the alternative investment space.

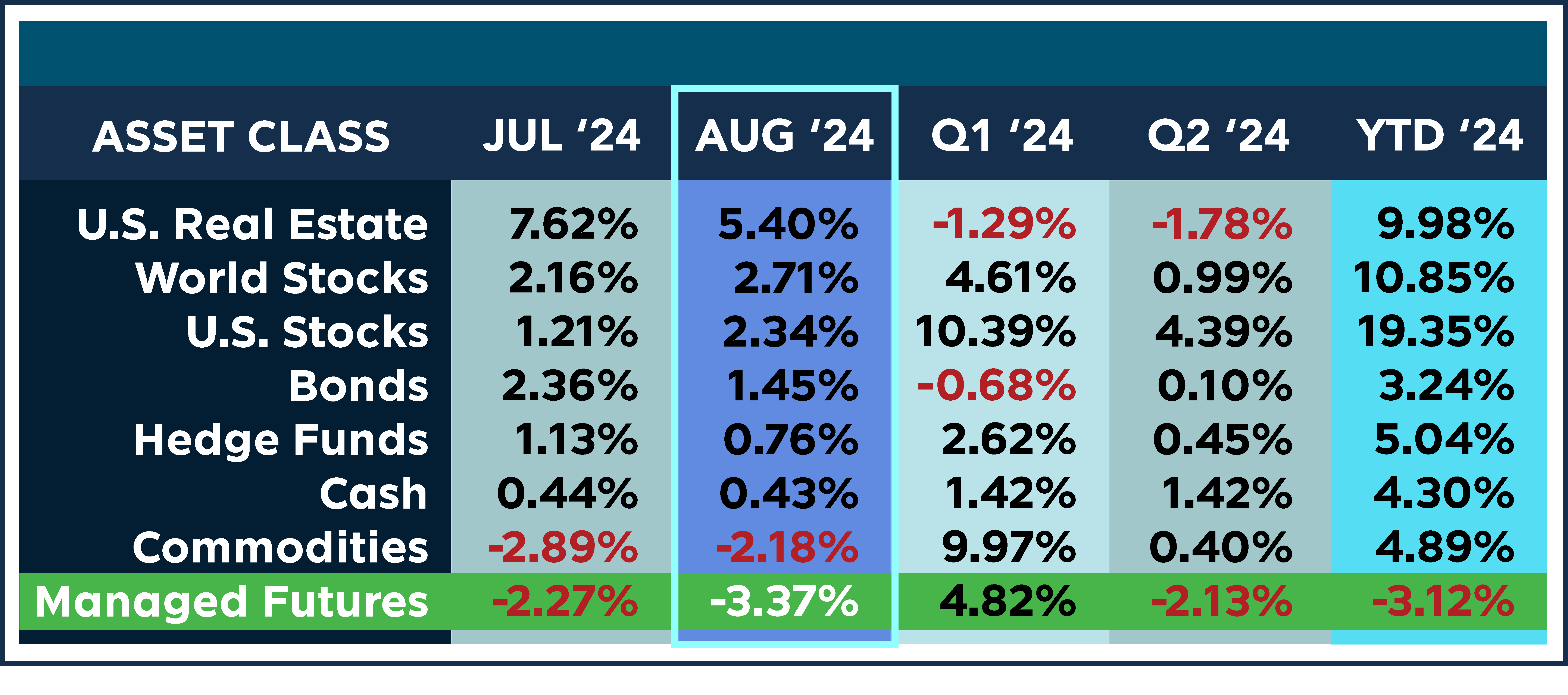

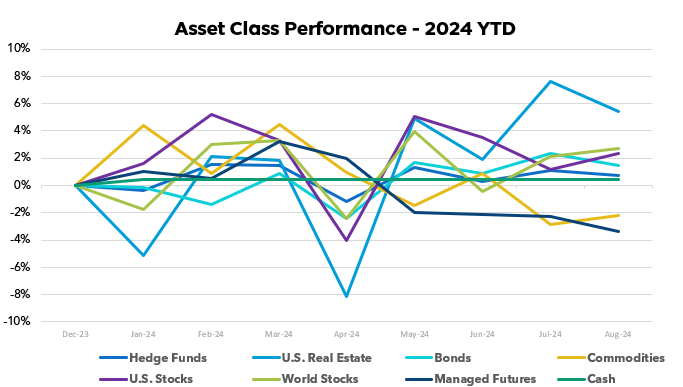

Asset Class Scoreboard: AUGUST 2024

U.S. real estate stole the show, with the IYR index showed gains of 5.40% as lower mortgage rates had buyers jumping for joy! U.S. and global equities also advanced, with the S&P 500 rising 2.34% and the ACWX world stock index climbing 2.71% on solid corporate earnings.

Bonds delivered positive returns of 1.45% as Treasury yields stabilized. Hedge funds increased by 0.76% , with the QAI index benefiting from diversified strategies across asset classes.

Conversely, commodities hit a bit of a bump, with the GSG index retreating -2.18% on moderating global growth. Cash yields remained stable at 0.43% .

Managed futures reencountered challenges last month, with the index dropping -1.10 as the result of -3.37 % at the end of August as trend-following strategies navigated choppy price action across markets.

What’s next: As the global economy digests the impact of monetary tightening, active management and flexible strategies like managed futures could play an increasingly important role in portfolios. Their ability to adapt to shifting market conditions may provide resilience amid potential volatility.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:

BND

),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:

QAI

)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:

GSG

);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:

IYR

);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:

ACWX

);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:

SPY

)

All ETF performance data from Y Charts

The post Asset Class Scoreboard: AUGUST 2024 appeared first on RCM Alternatives .