MOTR Capital Management provides actionable, unbiased and systematic research based on the most important market trends.

Next Oversold is Still a Buy

*Based on our systematic research process, we continue to believe that investors should be buying market weakness into support. The article below was posted to MOTR Research on August 2 nd just before the historic volatility surge. While our conviction was certainly tested, we reiterated that view in several more notes during the heat of that deccline. If you would like to view those reports, and receive future reports with no delay, begin your free trial today !

Highlights

- Under the weight of the MAG7, we should expect that the S&P will make its way to its 200-day moving average in coming months (perhaps -7% from its peak by the time the two meet in Sep or Oct).

- While we will need to see how well the market’s internal condition holds up during such weakness, our take is that at minimum, it is good enough today to expect at least a meaningful tactical rally off the 200-day.

- Our plan is to be a buyer of this weakness, but we’ll need to see if there is any real damage done during the selling to determine what to do into the overbought condition that follows.

- While we will be keying off of oversold breadth and momentum readings to identify proper buying setups, we will also be monitoring the volatility index (VIX) and curve.

The battle between improving small & mid-caps and deteriorating mega-caps is in full swing. While it is clear that continued weakness from the likes of the MAG7 will most assuredly drag the S&P and NDX down with them, it is not yet clear that the SMID-caps will share the same fate.

Ideally, of course, we would have all aspects of the market in sync, a condition we have not seen in over three years. We can’t control the cards we are dealt, we can only play them, and from what we see in our systematic review of the market and its internals, the next oversold condition is at least a tactical buy.

We suspect that this correction will not be over until sometime around the elections. That low is likely to occur somewhere in the vicinity of what should then still be a rising 200-day average (Figure 1, red dotted line).

As the 200-day average makes its way into our long-term Momentum Support Zone (496-527), we should begin to see evidence of stability. For the month of August, the long-term Momentum Zone is backed up by the medium-term Support Zone (493-512). We don’t expect to see the market get that low without seeing meaningful rallies along the way, kicked off by intermittent oversold conditions. Comparable levels for the NDX 100 ETF (QQQ) are 425-453 (long-term Momentum Zone) and 408-430 (medium-term Trend Support Zone).

As it is, the SPY is right in the middle of the medium-term Momentum Support Zone (536-545). However, lacking a proper oversold condition (50% of the MOTR Universe is still above its 15-day moving average), we are not willing to step into this weakness just yet.

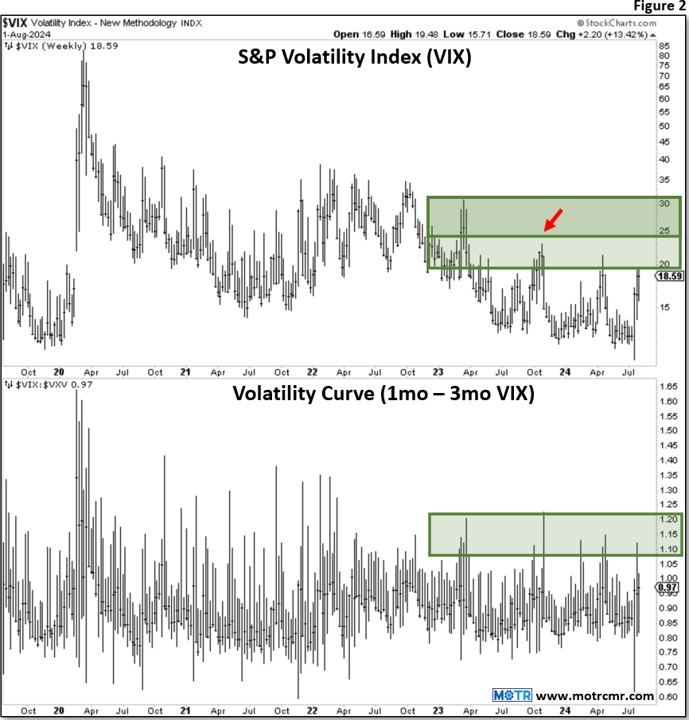

While we await oversold conditions from breadth and momentum, we are also mindful that volatility will likely spike at the same time (Figure 2). The VIX (top panel) can be expected to spike to as much as 30 during ‘normal’ market corrections, but it is more likely to find a peak in the mid-20s, as it did in October of last year (red arrow).

Similarly, the VIX curve (lower panel), which is the spread between the 1-month and 3-month volatility readings, can spike to as much as 1.20. We will be watching for a tradeable market bottom when the curve gets closer to the 1.15 area.

Ultimately, we are monitoring for meaningful trend damage in the monthly (medium-term) timeframe. Whether or not we can identify such damage during this weakness, we think the market is a buy either way.

What will change is our expected holding period for any buying we do, and hence, what we plan to do into the next overbought condition. Lacking any concerning damage, we will view the resulting oversold condition as an important cycle low with new highs expected in subsequent months. However, should we see too much damage in our trend models, our plan will be to lighten longs into the next overbought condition, and depending on just how bad it is, we might even be layering on short exposure.

As we have been saying, the best way to navigate this period of uncertainty is to handle it one 5% swing at a time. If the S&P reaches the long-term (quarterly) Momentum Zone as indicated in Figure 1, that would represent a roughly -7% decline off the highs. Remain cautious until then, but be prepared to reverse course tactically as we close in on the 200-day average.

Our Latest Thoughts:

Despite the volatility surge in August, according to our systemmatic modelling process, market internals have actually improved. We are providing new support levels for clients to monitor as we head into the elections, with a focus on the SPY, QQQ, and MAG7 stocks in particular. If you'd like to recieve these updates, head over to MOTR Research and start your free trial today!