Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

10-Year Outlook: Why Central Banks May Concede Inflation Above Their Targets

Central banks likely will concede inflation rather than create undue economic harm

The diverging paths of economic growth and inflation has challenged monetary policymakers and investors. Aging populations, higher government debt, the green transition and regionalization are simultaneously holding back economic growth and supporting high inflation. We think central banks like the Federal Reserve and European Central Bank will concede inflation above their 2% inflation targets, which could impact the market outlook and portfolio construction for investors.

Diverging Inflation and Economic Trends

Over the next 10 years, we expect the developed-market annualized rate of inflation to come in at 2.4%. We forecast 2.6% for the U.S., with Europe lower at 2.2%. While a moderation from the elevated levels of recent years, this leaves inflation above the 2% level targeted by most central banks, including the European Central Bank, Bank of England and the Federal Reserve.

We expect changing global politics and deepening rivalries to contribute to structurally higher inflation. Pandemic-induced supply-chain struggles and China’s increasingly forceful posture have pushed the U.S. and Europe to prioritize building more reliable supply chains, especially with strategically critical technologies such as semiconductors.

As global trade wanes, the efficiencies globalization created over the past few decades likely will fade as well. We expect the new trend of regionalization to increase costs and sustain inflation. Similarly, the buildout of clean energy technology and manufacturing to support it likely will support regional energy stability and lower prices in the long-term. But in the meantime, we expect countries to rely on fossil fuels to support their economies, keeping commodity prices elevated.

While inflation has trended up, the global economy is trending down — and for similar reasons. Heavy investments to realign supply chains and counteract climate change will likely divert money from investments that would produce economic growth. Elevated interest rates will make high government debt levels more costly. Also, the economic drag of aging populations challenge most of the developed world and especially China. We forecast a 2.4% real annualized growth rate for the global economy over the next 10 years, an underwhelming expansion relative to the prior decade.

A Difficult Reality for Central Banks

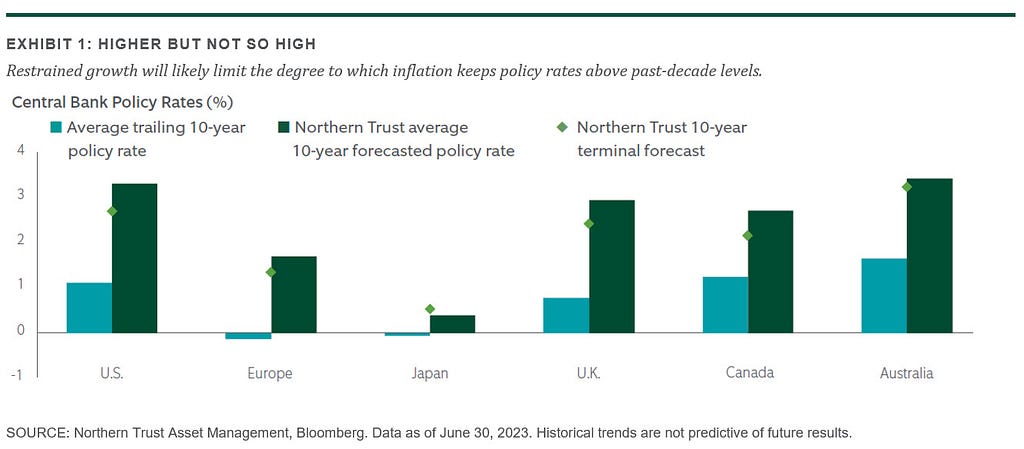

Faced with the reality that these forces are beyond central bank control, we expect monetary policymakers to concede some ground and allow for modestly above-target inflation. Not doing so could be too costly in terms of lost economic growth and may open them up to political criticism regarding their somewhat arbitrary inflation targets. As central banks lay down their arms, we believe policy rates will start to decline in 2024. We forecast 10-year policy rates below today’s levels across most of the major central banks (Exhibit 1).

We expect that politicians, investors and consumers will likely need to adjust their behavior to this new era of higher rates, elevated inflation and less powerful central banks. Rising demands for public spending and aggressive investments to implement the green transition and regionalization will likely make the road bumpy.

The Impact on Investment Portfolios

For investors, Central Bank Concessions , one of our investment themes in our recently published 10-year outlook , may be important to consider when assessing the financial market outlook and building investment portfolios. At a minimum, it could result in modestly lower policy rates than the inflation regime would normally dictate. At a maximum, it removes central banks as the center of attention for financial markets.

Of course, that last part cuts both ways. Central banks may not hold the markets hostage with hawkish commentary and overly tight monetary policy, but nor would they provide the “central bank put” to markets when times get tough. We think the proverbial monetary flood is a thing of the past. From the perspective of the global economy and financial markets, conditions likely will continue to resemble something of a monetary drought.

To learn more about 10-year investment themes and return forecasts, visit our 10-year outlook website to download the full research paper.

How is this blog post? Click one: Like it — Just okay — Don’t like it

For more insights, visit pointofview.northerntrust.com .

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. (NTI) or its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe (NTI) or its affiliates’ efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by (NTI) or its affiliates. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2A of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are (NTI) or its affiliates’ current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Hypothetical portfolio information provided does not represent results of an actual investment portfolio but reflects representative historical performance of the strategies, funds or accounts listed herein, which were selected with the benefit of hindsight. Hypothetical performance results do not reflect actual trading. No representation is being made that any portfolio will achieve a performance record similar to that shown. A hypothetical investment does not necessarily take into account the fees, risks, economic or market factors/conditions an investor might experience in actual trading. Hypothetical results may have under- or over-compensation for the impact, if any, of certain market factors such as lack of liquidity, economic or market factors/conditions. The investment returns of other clients may differ materially from the portfolio portrayed. There are numerous other factors related to the markets in general or to the implementation of any specific program that cannot be fully accounted for in the preparation of hypothetical performance results. The information is confidential and may not be duplicated in any form or disseminated without the prior consent of (NTI) or its affiliates.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

P-091323–3108106–091224

10-Year Outlook: Why Central Banks May Concede Inflation Above Their Targets was originally published in Point of View on Medium, where people are continuing the conversation by highlighting and responding to this story.