Attractive EMD Entry Point After COVID-19 Shock

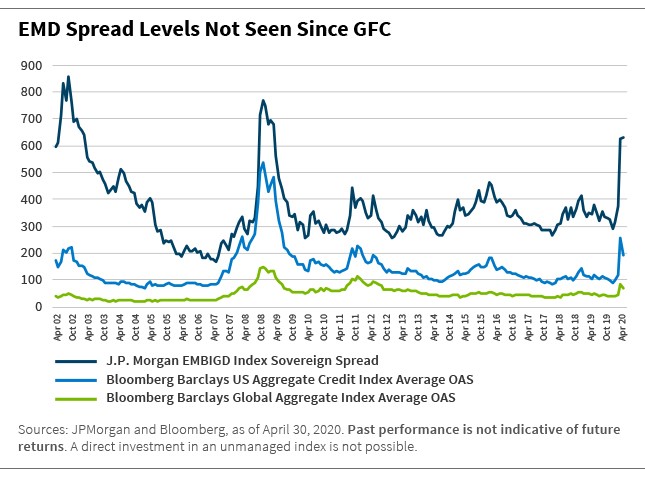

The COVID-19 shock to the global economy has sent emerging markets debt (EMD) spreads to levels not seen since the global financial crisis. We believe this rise in EMD’s risk premium is overdone and underappreciates the fundamentals of the asset class, creating potential opportunities and an attractive entry point.

A Technical Sell-Off

Emerging market (EM) economic activity has collapsed amid the pandemic, along with economic activity globally. Before the current crisis, we were expecting gross domestic product (GDP) growth for the investable universe of the J.P. Morgan EMBI Global Diversified to be around 3.5% on average annually over the next two years. We now expect an average annual growth rate of slightly below 1%. We anticipate an extremely gradual and uneven recovery, likely with low-beta regions such as Asia leading the way and high-beta regions like Africa lagging.

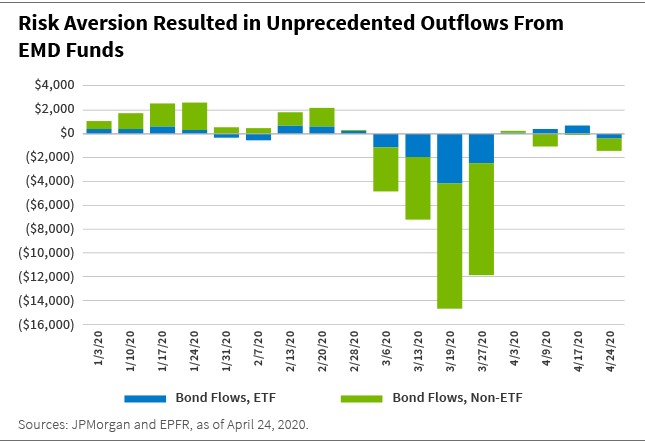

Concerns about this worsening outlook and its potential negative implications for EMD creditworthiness led to unprecedented outflows from EMD funds during March and April of this year. Investors pulled out more than $40 billion from dedicated EMD funds over the three months ending April 24, as the chart below shows. Outflows from EMD funds moderated in May, and more recently we started seeing small inflows into hard currency EMD funds.

These outflows created massive forced selling pressures, especially among exchange-traded funds (ETFs), amid poor market liquidity conditions. This led to significant price decreases, especially in the less-liquid, higher-yielding part of the EMD market. These major price dislocations drove spreads to extremely high levels in a matter of days, and EMD underperformed other credit asset classes during this process. However, spreads have compressed around 100 basis points (bps) over the past month, reflecting better technical conditions driven by stable to marginally positive flows.

Overblown Concerns

EMD fundamentals are certainly challenged by the global economic downturn. Yet the concerns about systemic risks that sparked the EMD outflows appear overblown, in our view.

We expect that EM default risk will be well contained going forward, given that the fundamental backdrop in most EM countries remains constructive. Overall levels of EM public debt are significantly below those in developed economies, growing only gradually over the last few years.

Improving liquidity conditions are supportive of EMD too. Current account balances have improved in recent years, and low inflation has enabled central banks globally to provide unprecedented monetary stimulus. This backdrop should keep the overall levels of global rates extremely low for a considerable period of time.

There also is ample multilateral and bilateral funding available for EMs. The IMF is able to lend about $1 trillion to its member countries and has been moving quickly and aggressively to provide liquidity support for EM countries in need. Meanwhile, the G-20 has approved a debt relief program for low-income EM countries, and the banking sector in most EM countries appears very solid, with high levels of capitalization.

The favorable liquidity environment and ample funding availability limit the scope for widespread technical defaults and should help contain a debt crisis in EMs.

The favorable liquidity environment and ample funding availability limit the scope for widespread technical defaults and should help contain a debt crisis in EMs, in our view. We see credit events limited to a handful of countries, most of them are already headed in that direction.

Attractive Valuations

We find current EMD risk premiums overstate the credit risk relative to other fixed-income asset classes and to historical levels, implying an unrealistic probability of default. As a result, we see scope for EMD spreads to compress over the medium term, as normalizing market conditions may send EMD prices higher and yields lower.

Technical conditions—including high volatility and expensive transaction costs—have likely kept some investors from coming back to the EMD market so far. However, EMD outflows have moderated significantly recently, and there was very strong primary-market activity in April, with more than $55 billion in EMD issued in April and close to $30 billion issued so far in May. The strong demand for EMD bonds in the primary market reflects what we believe is the attractive valuation of the asset class.

A considerable portion of the investible EMD universe is currently trading below what we perceive to be fair value.

Against this backdrop, current valuations appear attractive. A considerable portion of the investible EMD universe is currently trading below what we perceive to be fair value based on our fundamentals-first approach to sovereign credit analysis. Our approach includes comprehensively assessing an issuer’s credit-risk profile and ranking the creditworthiness of countries.

Investing Implications

We believe investors with longer-term time horizons have rarely seen such an attractive opportunity to go long on EMD. Ex-post credit losses versus what is priced in by markets today are likely to differ wildly, potentially boosting returns for the long-term investor.

We believe investors with longer-term time horizons have very rarely seen such an attractive opportunity to go long EMD.

Our proprietary quantitative model and combined top-down, bottom-up approach help us identify strong relative value ideas. We are region-agnostic and prefer to segment our investable universe into three buckets based on different risk profiles : low-beta, middle-beta, and high-beta countries. We are defensively positioned overall but have a small allocation to distressed, high-beta, high-yield countries, where the average bond price is compelling.

We see opportunities in today’s environment to add selected exposure across our buckets.

In the low-beta segment, we are trying to prioritize positions in EMs where we find fundamental strength, including faster-growing economies, ample fiscal space, and strong balance sheets; examples include Russia, Kuwait, and Hungary.

In the medium-beta segment, we are overweight on Guatemala, Qatar, and select Brazilian corporate credits, because we feel they offer strong fundamentals and decent valuations.

In the high-beta segment, we are overweight on Argentina, Ecuador, and Lebanon, which are trading at distressed levels, and Ukraine, which has strong support from the International Monetary Fund.

EMD has historically displayed very high-risk adjusted returns over the long run, given the asset class’s income potential, relatively low default risk, and relatively high post-crisis recovery values. We do not see this changing, even if we see some pickup in EMD default risk in the near term. This means we view today’s overstated spreads as an attractive entry point.

Marcelo Assalin, CFA, is a portfolio manager on and head of William Blair’s Emerging Markets Debt team.

Investing involves risks, including the possible loss of principal. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. Rising interest rates generally cause bond prices to fall. Sovereign debt securities are subject to the risk that an entity may delay or refuse to pay interest or principal on its sovereign debt because of cash flow problems, insufficient foreign reserves, or political or other considerations. High-yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Diversification does not ensure against loss. Portfolio information is based on a representative portfolio and is subject to change without notice. Past performance is not indicative of future returns.

Beta is a quantitative measure of the volatility of a portfolio relative to the overall market, represented by a comparable benchmark. Option‐adjusted spread (OAS) is a measure of the spread of a fixed income investment’s yield relative to a benchmark, adjusted to take into account an embedded option.

The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The Bloomberg Barclays US Aggregate Credit Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. The J.P. Morgan Emerging Market Bond Index Global Diversified (EMBIGD) tracks the total return of U.S.-dollar-denominated debt instruments issued by sovereign and quasi-sovereign entities.

RSS Import: Original Source