Creator and Co-Manager of ETF products

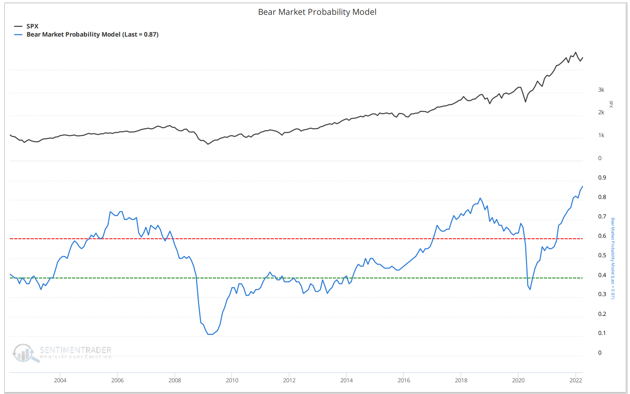

Bear Market Odds Model Surges

- April 19, 2022

- Brad Lamensdorf

- Chart of the Week

By John Del Vecchio and Brad Lamensdorf

A bear market prediction tool monitored by Goldman Sachs has surged in recent months to its highest level in decades. Here is a chart courtesy of SentimenTrader.com

This is a model outlined by Goldman Sachs using five fundamental inputs – the U.S. Unemployment Rate, ISM Manufacturing Index, Yield Curve, Inflation Rate, and P/E Ratio.

Each month’s reading is ranked versus all other historical readings and assigned a score. The higher the score, the higher the probability of a bear market in the months ahead.

When the model was 20% – 29%, the S&P’s average one-year return was +21%.

But when the model was 80% – 89%, that average return plunged to -2%. So the higher the model, the greater the chance for a bear market, or at least negative forward returns.

Time to up the hedges?