Creator and Co-Manager of ETF products

Bear Market Rally?

- March 23, 2022

- Brad Lamensdorf

- Chart of the Week

By John Del Vecchio and Brad Lamensdorf

The riskiest assets have seen a massive rebound.

Many stocks are up 20-30% or more off the recent lows in just a week.

Has the bottom been put in, or is this a bear market rally?

One of our favorite indicators suggests that it is time to add back hedges.

Aggressively.

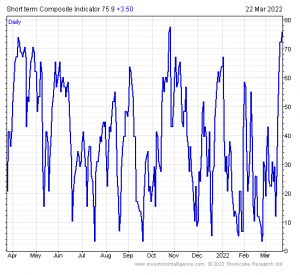

The Short-Term Composite Indicators, courtesy of Investors Intelligence is now exceptionally overbought. At a level of 75.9, we are in nosebleed territory.

The indicator measures dozens of short-term and intermediate-term technical factors. The market is the most overbought it has been in months.

At a level that preceded pain the last time we got there.

While no indicator is perfect, we find that at extreme levels (both overbought and oversold) there are favorable risk/reward ratios. Now presents such a time to fade the market.