ESG Integration and Engagement: South Africa Sovereign Credit

A version of this material will appear in a CFA Institute paper.

Environmental, social and governance (ESG) indicators are integral to PIMCO’s sovereign credit assessments, which inform our investment decisions. But how exactly do we incorporate ESG considerations into our decisions?

In addition to rigorous analysis of ESG and other risk factors, in-country engagement is key for us to gain a holistic sense of broader developments, pinpoint country-specific risks, share in active dialogue with public officials and business leaders, and assess governments’ track records in meeting ESG objectives. We detail our approach in our recent Viewpoint , “ Applying ESG Analysis to Sovereign Bonds ,” and our experience in assessing South Africa’s sovereign credit, in particular, offers a concrete case study of how active engagement and thorough ESG analysis helps shape portfolio strategy.

ESG sovereign risk case study: South Africa

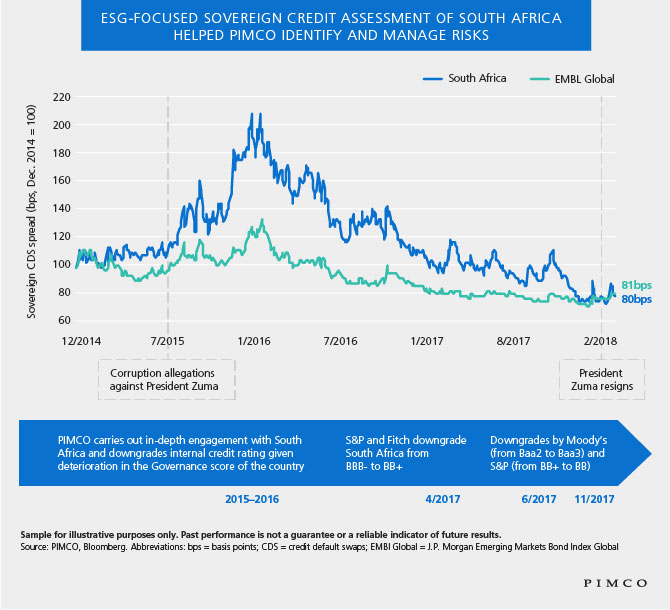

Political developments in South Africa in 2015–2017 highlight how integrating ESG factors into traditional sovereign credit analysis as well as timely engagement can potentially improve risk assessments and shield portfolios from large downside risks.

In July 2015, allegations of corruption emerged with regard to former South African President Jacob Zuma. Criticism focused on a nuclear energy agreement between South Africa and Russia, which was believed to be engineered for President Zuma’s personal gain to the detriment of a South African public utility. President Zuma was also accused of having a corrupt relationship with the Guptas, a prominent South African business family. A power struggle within the African National Congress (ANC) followed, resulting in a weakening of South Africa’s institutional framework, with frequent changes of finance ministers, fiscal slippage and political turbulence.

When the allegations first surfaced, we initiated a reassessment of South Africa’s political and governance risks, and a senior PIMCO team made a due diligence trip to the country. The objective was to understand the economic and institutional impact as well as the social consequences of the diversion of fiscal resources away from health and education.

PIMCO’s assessment prompts internal downgrade

Following in-depth discussions with the government and a detailed analysis, we downgraded our internal credit rating for South Africa several quarters before the major rating agencies did (see chart). The weight of the governance indicators within our sovereign ratings, our assessment of the impact of weaker institutions on economic growth and on the country’s debt burden, and our engagement with senior government officials all drove our decision to downgrade.

Our downgrade in turn led us to re-evaluate our portfolio exposure to South African sovereign and quasi-sovereign risk, and led us to make a call to reduce exposure across PIMCO accounts. Due to the integration of ESG factors in our standard sovereign risk framework, we were able to identify problems early and reduce exposure when the markets were still pricing in a favorable scenario for South Africa. Over time, as the extent of the corruption became known, the markets and the rating agencies caught up with our assessment.

Continuous analysis and engagement

From 2015–2017, we remained engaged with the government and key stakeholders in South Africa. This enabled us to better understand the political dynamics and relay investors’ concerns directly to decision makers.

As global macroeconomic conditions improved, the markets started to reprice South Africa positively, but our negative view on governance and transparency led us to remain cautious, particularly as there was a good chance that President Zuma’s policies would continue if his ex-wife, Nkosazana Dlamini-Zuma, won the leadership of the ANC.

With the election of President Cyril Ramaphosa as leader of the ANC in December 2017 and the exit of President Zuma from politics in February 2018, we are monitoring the new government’s progress in correcting management gaps in the state-owned enterprise sector and advancing reforms to improve governance and transparency. The procedures being put in place to reduce corruption are promising signs that South Africa is finally on the long road to recovery.

Learn why we believe the bond market is uniquely suited to both benefit from and provide finance for ESG-related efforts.

Lupin Rahman is a portfolio manager on the emerging markets team, specializing in sovereign credit and monetary and currency policy analysis.

RSS Import: Original Source