Segall Bryant & Hamill leverages its proprietary investment research, deep industry experience and long‐tenured team to provide intelligently constructed portfolio solutions.

Fed Pauses, Volatility Does Not

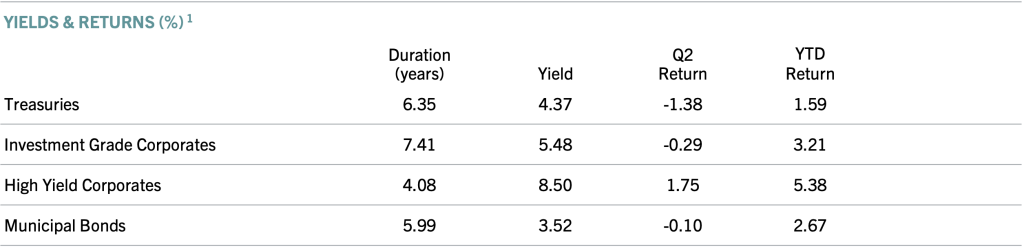

Second quarter returns were negative across most of the fixed income landscape. Every subsector of the Bloomberg U.S. Aggregate Bond Index (the Agg) posted negative absolute returns for the quarter while outperforming similar-duration Treasuries, which did even more poorly while exhibiting continued volatility.

Early in the quarter, the market was still digesting the impact of regional bank failures and weighing the potential for additional rate hikes from the Federal Reserve (Fed). The economic news was somewhat mixed as inflation measures continued to show progress, but employment numbers remained strong. The Fed’s response was measured; a quarter-point rate hike at its May meeting and a pause in June–breaking a streak of 10 straight meetings with a decision to raise rates. Yields on Treasuries moved higher across the entire curve, and the 2s/10s curve inversion (the excess of the yield on 2-year Treasuries versus 10-year Treasuries) finished the quarter at its most extreme level since 1981.

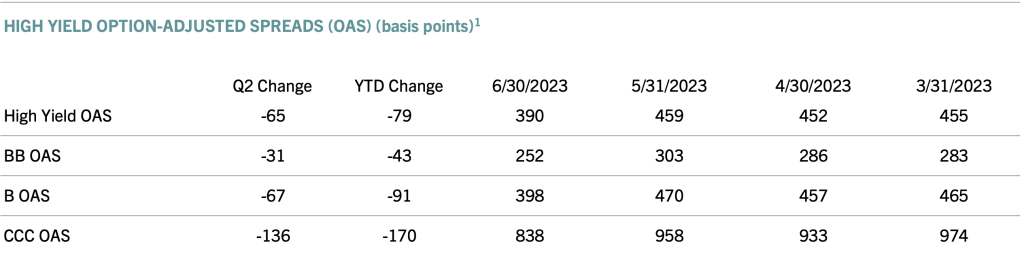

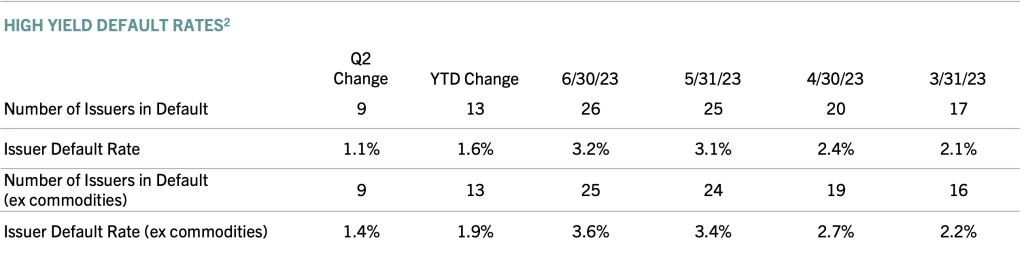

Corporate bond spreads were mixed over the first two months of the quarter. June was marked by a relatively strong first quarter earnings season and continued economic resilience, which led to spreads finishing the quarter generally tighter across both investment grade (IG) and high yield (HY). In IG and HY, the most pronounced spread move (wider) came from Financials. HY corporates were among the strongest-performing areas of fixed income for the quarter, led by the lowest-rated CCC category, as spreads tightened by double digits for all HY ratings categories. Concurrently, the high yield default rate increased by over a full percentage point as higher rates continue to take a toll on lower-quality issuers.

Read on for more details on the fixed income markets in the second quarter, and tune in here for continued analysis over the back half of 2023.

Market Summary

Returns were mixed in the second quarter. High yield corporates had the strongest absolute returns, while Treasuries were the weakest.

U.S. Treasury Market

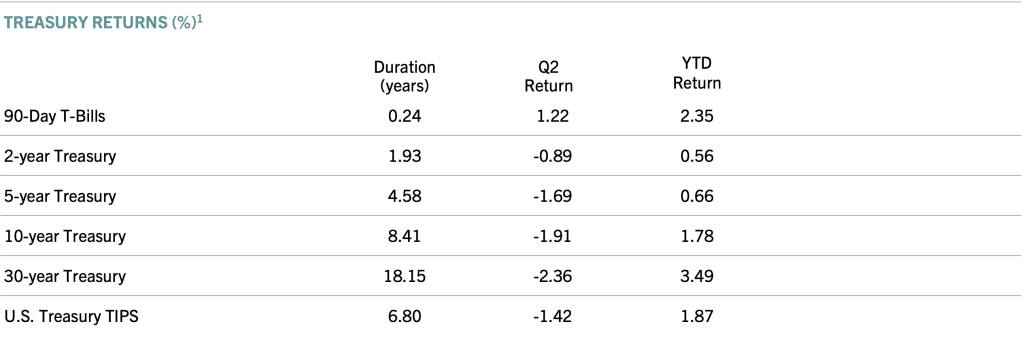

Treasury yields rose across the entire curve, with more pronounced moves on the shorter end of the curve. The excess of the 2-year Treasury yield over the 10-year Treasury yield ended the quarter at 1.06% – the highest such inversion since 1981.

Returns were negative for Treasuries on all but the shortest maturities. Long Treasuries were the worst performer.

Broad Investment Grade

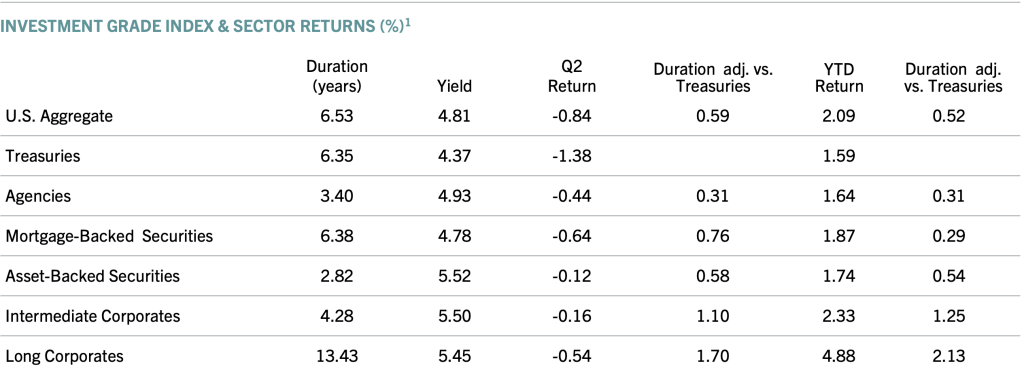

The Agg and all its sub-sectors posted negative returns for the quarter while outperforming similar-duration Treasuries. Year-to-date returns are still positive for all sub-sectors, led by long corporates.

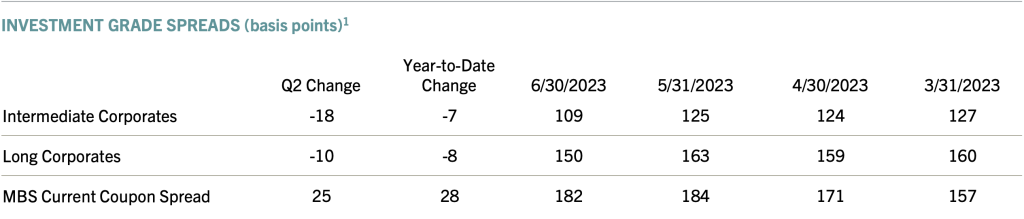

Corporate spreads tightened in June and ended the quarter tighter than where they began. Current-coupon MBS spreads widened, although they tightened slightly in June.

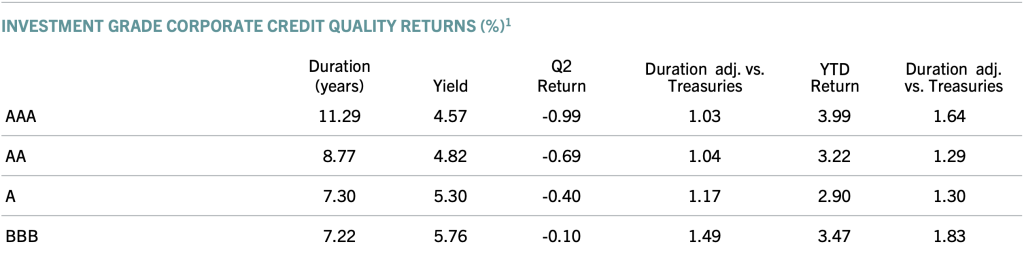

Corporate bond returns were negative for the quarter in absolute terms but remain ahead of Treasuries. Returns are still solidly positive year-to-date, led by BBBs.

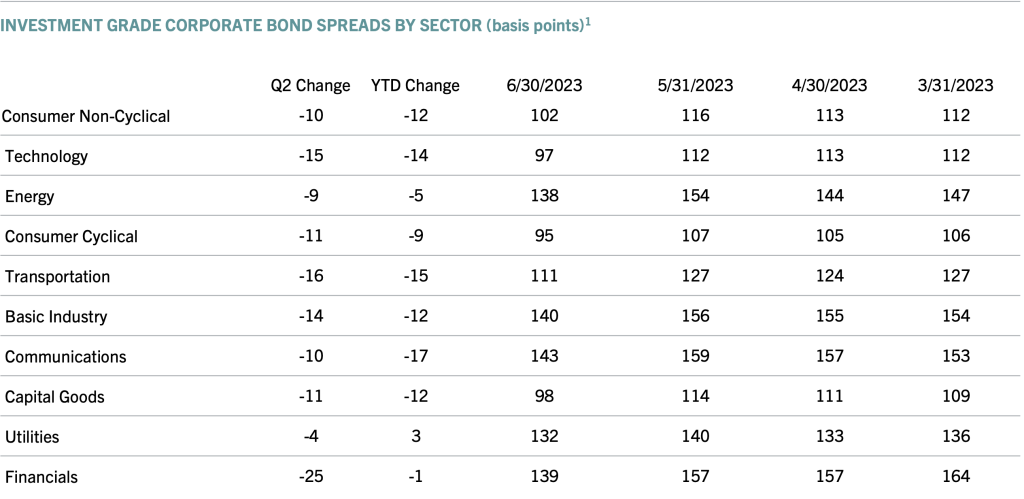

Investment grade corporate spreads tightened for all sectors. The most pronounced moves tighter were in Financials, Transportation, and Technology – all of which realized most of the quarter’s spread move in June.

High Yield

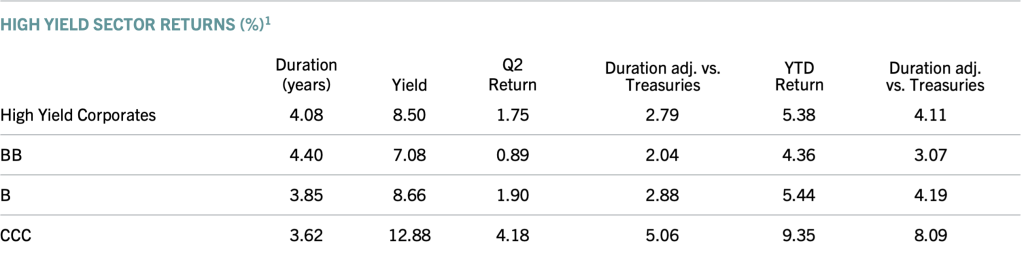

High yield corporates performed well in the quarter, as spreads tightened across all ratings categories. The strongest performing ratings category was CCC, which is up nearly 10% year to date.

Every high yield category aside from Utilities tightened for the quarter. Financials and Transportation tightened the most.

The number of high yield defaults over the last 12 months continues to inch higher, although the HY default rate remains low from a historical perspective.

Municipals & Other

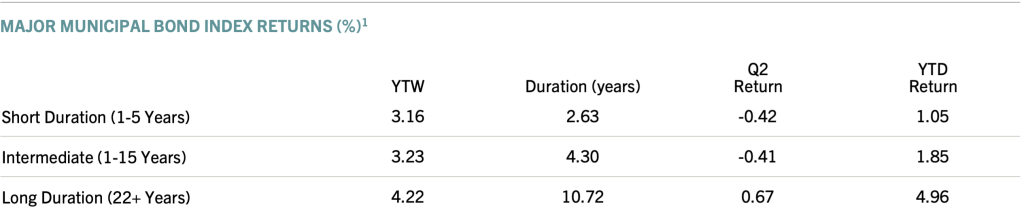

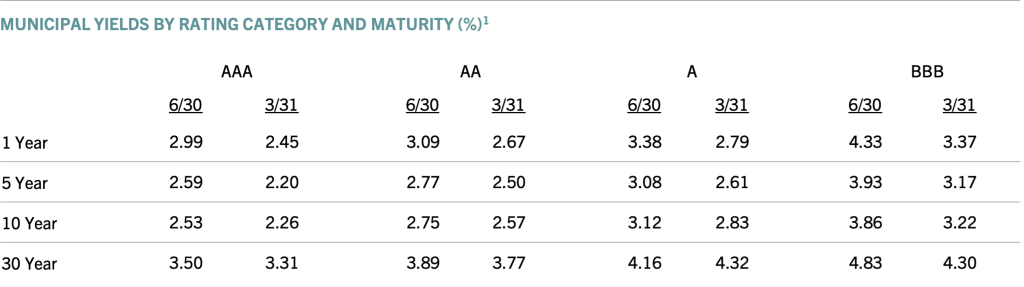

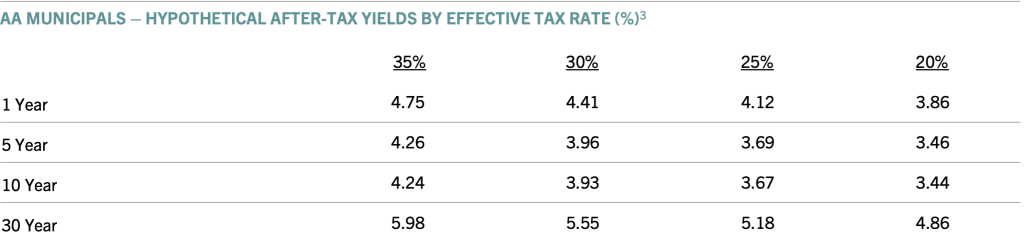

Municipal bonds had a decent quarter relative to most fixed income categories. Yields on munis rose across virtually the entire spectrum of quality and duration.

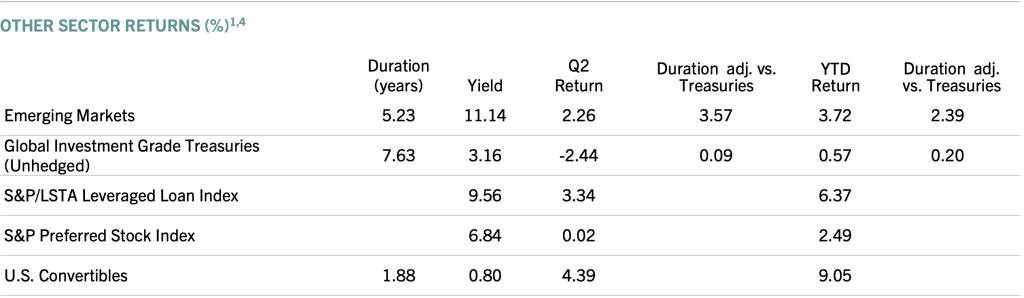

Global IG Treasuries produced a loss in the quarter, but the remaining “other” sectors were positive. Convertibles and Leveraged Loans have produced the strongest returns for this group over the first half of the year.

Learn more about SBH’s Fixed Income Strategies .

This update provides an overview of certain broad-based Fixed Income benchmarks and does not include performance of the Segall Bryant & Hamill Fixed Income styles. Past performance cannot guarantee future results. All investments involve risk, including the possible loss of capital. All opinions expressed in this material are solely the opinions of Segall Bryant & Hamill. You should not treat any opinion expressed as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the manager’s opinions. The opinions expressed are based upon information the manager considers reliable, but completeness or accuracy is not warranted, and it should not be relied upon as such. Market conditions are subject to change at any time, and no forecast can be guaranteed. Any and all information perceived from this material does not constitute financial, legal, tax or other professional advice and is not intended as a substitute for consultation with a qualified professional. The manager’s statements and opinions are subject to change without notice, and Segall Bryant & Hamill is not under any obligation to update or correct any information provided in this material.

1 Source: Bloomberg.

2 Source: Bank of America Merrill Lynch.

3 Hypothetical yields are calculated as the AA municipal yield divided by (1-tax rate). Actual tax-adjusted yields will depend on individual tax circumstances.

4 Source: Standard & Poor’s.

Loading PDF