Creator and Co-Manager of ETF products

Have We Seen The Low?

- March 15, 2022

- Brad Lamensdorf

- Chart of the Week

By John Del Vecchio and Brad Lamensdorf

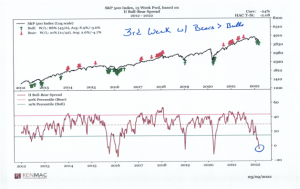

The level of bearishness in the market has now reached an extreme level.

Historically, with so many investors leaning in the bearish direction, it has typically been a profitable time to accumulate stocks.

Based on the current Bull vs. Bear spread, and a 13-week forward outlook, 88% of the time the market has rallied. The average return is 8.9%

The chat below illustrates that the level of bears is among the highest in the last 10 years.

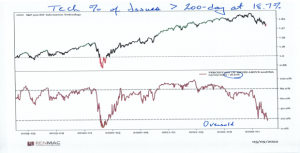

Meanwhile, while bearishness is at extreme levels, technology stocks are washed out. The percentage of issues below their 200-day moving average has now fallen below 20%. As a result, as illustrated in the chart below, technology issues are deeply oversold. The last time technology stocks were this oversold (COVID lows), the market experienced a substantial rally

The combination of too much bearishness and a deep oversold level is creating conditions for a massive bounce.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.