Creator and Co-Manager of ETF products

In from the Dark

- February 4, 2022

- Brad Lamensdorf

- Chart of the Week

- 0 Comments

By John Del Vecchio and Brad Lamensdorf

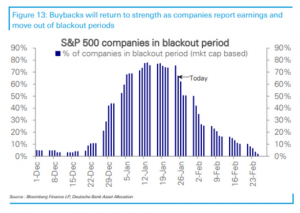

One of the key drivers of the stock market in recent years has been share buybacks.

Recently, companies have been in a blackout period and that coincided with a dismal start to 2022.

As the chart below shows, the number of black out dates is fading rapidly.

In from the Dark

The chart was published in Mid-January and we are now more than three quarters through the blackout period.

As companies come out of the dark and buy back stock, it could be supportive of share prices.

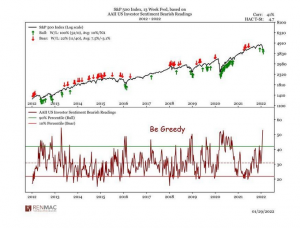

The black out period is fading at a time of extreme pessimism in the market.

There are simply too many bears right here, right now.

As the chart below shows, courtesy of RENMAC, when the level of AAII Us Investor Sentiment readings are this bearish , it’s time to be greedy.

If corporate management becomes greedy, history shows there’s substantial upside from here.

In from the Dark