Small-Cap Value: Ignored but Not Forgotten

Being a value investor has been challenging over the past 13 years, and there have been echoes of “value is dead” within the marketplace. But history has shown that investors who stick with value during challenging times could be rewarded.

The Case for Small-Cap Value

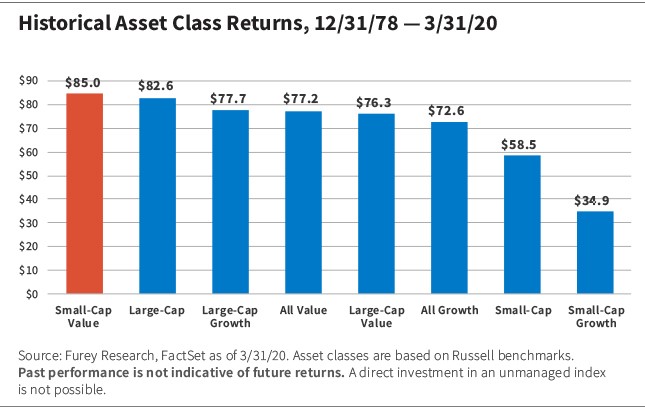

Financial research has widely documented that within equities, value investing (and more specifically investing in the small-cap value asset class) has the potential to provide better returns over time. The chart below illustrates how much investors would have earned had they invested $1 in each asset class, going back to the inception of the Russell indices in 1978. As you can see, small-cap value has been the clear leader over time.

Although value outperformed growth over the longer time period, this has not been the case recently, as some of the ingredients necessary for growth outperformance have been in place for several years. They include a declining and persistently low interest-rate environment, an elongated period of benign inflation, and positive but moderate long-term economic growth.

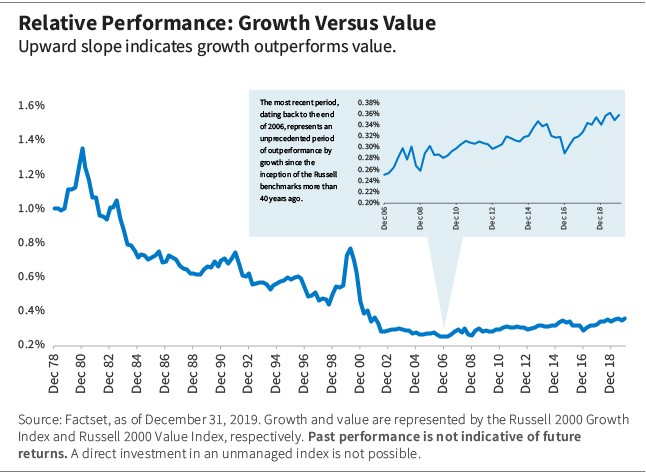

As illustrated in the chart below, this recent period represents the longest period of growth outperformance since the inception of the Russell-style indices.

This period has been heavily influenced by actions taken to address a once-in-a-generation financial crisis and, more recently, aggressive stimulus measures to mitigate the economic impact associated with the efforts taken to stem the spread of COVID-19. History has shown us that markets go through cycles, and if any of these conditions change, small-cap value could return to its leadership position.

What Will It Take for Small-Cap Value to Outperform?

A more conducive macroeconomic environment that facilitates a greater focus on company fundamentals and the reacceleration and broadening of domestic growth should provide a more fertile environment for value to outperform.

A more inclusive growth environment where more companies are delivering solid earnings growth would allow investors to expand their investable universe. This, in turn, should eliminate the need to flock to a more limited number of growth stocks to seek growth, which results in higher multiples for this smaller subset of companies with higher earnings growth.

While the current economic environment remains highly uncertain, if the economy experiences a cyclical rebound and we see more companies start delivering earnings growth, value could be poised to outperform.

Additionally, we believe higher interest rates should provide an opportunity for not only value to outperform growth, but for small-cap value to outperform all other domestic equity asset classes. This boils down to the general composition of the benchmarks.

Financials, more specifically banks, constitute a much larger percentage of the Russell 2000 Value Index and could benefit from a higher interest-rate environment due to improved lending margins.

We recognize that there would likely be an offset to higher rates given the negative correlation between the direction of interest-rate moves and relative performance by real estate investment trusts (REITs) and utilities. However, REITs and utilities may outperform in a recession even if the Fed lowers interest rates to spark growth.

While there are a number of moving parts in this part of our discussion, the main takeaway is that not a lot of change is necessary to provide for an environment in which small-cap value is ripe to outperform.

The present value of future corporate earnings and cash flows would also be impacted by higher rates. Growth companies tend to have more of their earnings and cash flow expected in the out-years, so applying a higher discount rate to these future earnings and cash flows would translate into a lower present value. This lower present value could result in the re-rating of growth stocks as valuations may need to be reset given their currently elevated levels relative to value stocks.

For the first time in U.S. history, the domestic economy started and ended a decade without going into a recession. This will change quickly as the speed and magnitude with which COVID-19 spread throughout the world, including the United States, will have a dramatic impact on the overall health of the domestic economy.

While the depth and duration of the subsequent economic downturn or recession resulting from the stay-at-home directives that essentially closed a large percentage of the economy are still too difficult to predict, these measures are already contributing to a significant increase in unemployment.

A normal economic downturn or recession may contribute to a diminished risk appetite for more expensive growth stocks, resulting in an attractive environment for value.

Valuation Is Attractive

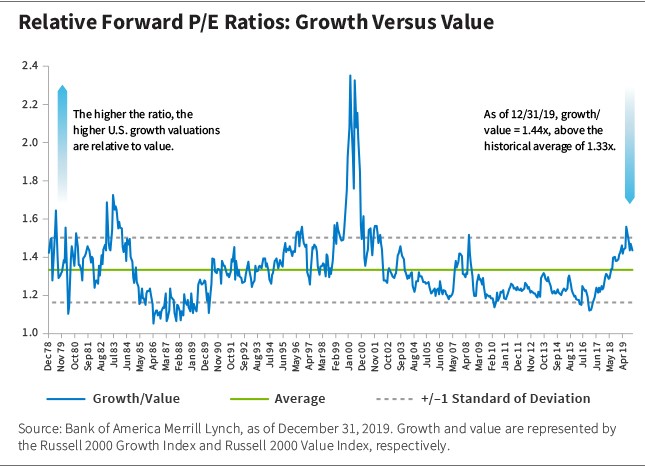

Growth stocks are expensive based on a number of valuation metrics, and an economic recession may result in relative multiples declining closer to historical averages (as the chart below illustrates).

While we are cognizant that just because something is overvalued does not mean it cannot get more overvalued, the valuation relationship between growth and value stocks is near its highs (excluding the dot-com years) and we believe this should be taken into account when considering growth stocks.

Stay the Course

Being a value investor has been more challenging than being a growth investor over the past 13 years, and there have been echoes of “value is dead” within the marketplace.

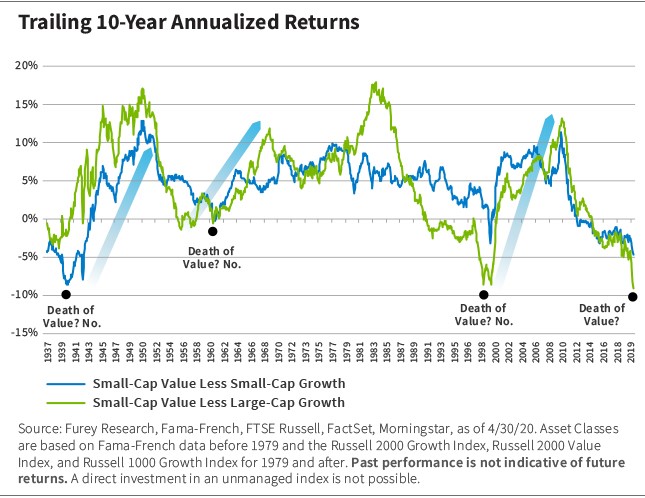

This is not the first time we have heard this tune, and it surely will not be the last time investors question value’s ability to outperform.

As shown in the chart below, each time investors have questioned the validity of value investing and the relative performance of small cap value to small-cap growth and large-cap growth has fallen to current levels, small-cap value has bounced back dramatically.

Value investing has trailed growth investing since the global financial crisis as the equity market has been driven more by macroeconomic events than company fundamentals. The post-crisis era has also been dominated by fast-growing, technologically innovative companies with the higher valuations that value investors typically avoid.

Investor risk appetite appears to have expanded as well, as evidenced by investors’ increased investments in the so-called “unicorn” stocks, which typically have significant leverage and limited-to-no earnings. The recent enthusiasm for these types of stocks seems to be on par with the highly speculative environment leading up to the tech bubble in the late 1990s. This was a period where investors prophesized about the demise of value investing and growth outperformed value. Value subsequently outperformed growth dramatically from 2000 to 2007.

We are strong believers that markets go through cycles, and the current extended period of growth-style outperformance will come to an end and value will again outperform. If one style of investing worked all of the time, everyone would pursue it, thus eliminating any sort of investment edge. This is why different styles tend to rotate into and out of favor over time.

We just do not know when the change will occur.

In the meantime, the severity and length of value underperformance over the past 13 years may entice some investors to throw in the towel and move away from value investing altogether. But we believe those that stick with value and commit to teams that have built a proven investment process and are committed to sticking to it during challenging times will be rewarded.

Matthew Neska, CFA, is the Portfolio Specialist for the firm’s U.S. value equity strategies.

RSS Import: Original Source