Jeff Gitterman is a co-founding partner of Gitterman Wealth Management, LLC, and a thought leader in the field of Sustainable, Impact, and ESG (Environmental, Social, and Governance) Investing.

The New Landscape of Sustainable, Impact and ESG Investing

On September 11th, 2018, Gitterman Wealth Management will co-host the Sustainable Investing Conference at the United Nations .

A year earlier, on October 19th, 2017, the firm hosted the NYC Sustainable ESG Investing Conference for Financial Advisors in mid-town Manhattan. One of the largest conferences of its kind for financial advisors in NYC brought together over 200 financial professionals to talk about the future of Sustainable, Impact, and ESG (Environmental, Social, and Governance) Investing.

Below is a transcript of a talk given by Gitterman Wealth Management Co-Founding Partner, Jeff Gitterman, to begin the day:

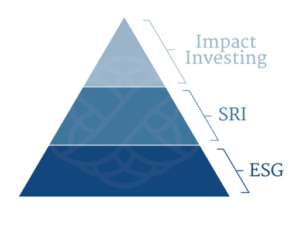

Jeff Gitterman : One of the things I wanted to do was level set the differences between ESG (Environmental, Social, and Governance), SRI (Socially Responsible Investing) and Impact Investing, and more importantly, also talk about how we can educate the advisory and RIA communities as to what these endeavors are and why they are so important.

Unfortunately, there are a lot of negative perceptions that remain about Socially Responsible Investing (SRI), because in the past, many advisors have believed, and in some cases rightfully so, that in order to invest in socially responsible ways, there needed to be a sacrifice on returns. What many advisors don’t yet know, is that largely due to the proliferation of computerized big data and artificial intelligence (AI), the landscape of sustainable investing is changing dramatically, and the idea that we need to sacrifice returns in order to invest in this way is no longer true.

At Gitterman Wealth Management , we talk about Sustainable Investing in terms of a pyramid:

As you can see, ESG Investing is at the base of the pyramid. In our firm, we refer to ESG as the “GPS of Investing,” in that we see many similarities between ESG data and a car’s GPS system. Twenty-five or thirty years ago, if we wanted to take a road trip, we would likely take out a large fold-out map to chart our course. And although this map might tell us how to get from A to B, it would tell us nothing about any potential delays or pitfalls we might encounter along the way – things like traffic delays or construction roadblocks, etc.

When I first began thinking about ESG, I was walking to work one day, and in my mind, I saw a GPS system. What does a GPS system do? It allows for information, accumulated through computerized big data and artificial intelligence (AI), to come into our car or handheld device, and help us navigate the trip we’re taking, alerting us about traffic and road conditions while providing us with live feed information to reroute us when necessary.

ESG is a similar type of data set, allowing us to think about companies far more in real time than the 10K financial statements do. I think about the 10Ks as the old fold-out maps, and I look at all this new ESG data that is coming in as the GPS on the companies that I’m looking to invest in.

ESG gives us real-time information from all over the world, about environmental, social, and corporate governance problems that companies are facing. It is a risk mitigator and alpha generator, which are topics that we will talk about in much more depth on today’s panels . ESG makes it easier for us to achieve our investment goals safely, by giving us all of this live data on a regular basis. It is simply a data set and the foundation of a good portfolio because it helps avoid the potential pitfalls and hazards of intangible asset risk, and will also allow us to vote with our money in ways that we cannot yet even imagine.

This brings us to next layer of the pyramid—SRI, or values-based investing. Above ESG, we can incorporate SRI screens into our process, where we can layer in a values-based approach with our clients by filtering out certain stocks or complete sectors. Examples of SRI screens include fossil fuel, firearms, tobacco, and many others. SRI can also be used to drive investment themes such as climate change, access to clean water, gender equality, etc. To be clear, SRI screens can be layered on top of ESG screens, but they are not the same thing at all.

There is a beautiful movie out by well.org , whom we now work with, titled “Prosperity,” and in it, they point out that if the entire world stopped chewing gum for about a month or so, the whole chewing gum industry would be completely wiped out.

Now, I personally like chewing gum and am not advocating this, but it is a great example of the power that we have as consumers and investors. We need to take away this top-down approach that we’ve all bought into, thinking that the only way to change a corporation is to get on its board and make changes from the top.

I am totally in favor of proxy voting because that is a bottom-up approach, but where and how we spend our money is even more powerful. Our research shows that 83% of millennials and 77% of women want values based investing1, and they will be the ones to turn this pyramid upside down.

At the very top of the pyramid, we have Impact Investing, which we define as an investment into a company with the intention of generating a measurable environmental and/or social impact alongside a financial return.

When talking about companies with regard to Impact Investing, the first question we ask is if they are willing to have themselves measured against a standard, such as the United Nations’ Sustainable Development Goals (SDGs), or the Principles for Responsible Investment (PRI). Are they reporting on a regular basis, and willing to report to their shareholders on how they are affecting the SDGs and mitigating problems? This is Impact Investing.

We offer ESG, SRI, and Impact Investing for our clients, as well as research, education, and investing services for financial advisors outside of our firm. But even with clients that don’t have a values tilt; I still incorporate ESG data into their portfolios. Because again, why would we use an old map when we have all of this GPS data at our disposal? As financial advisors, I feel it is our fiduciary responsibility to at least look at the data. We have to look at it.

As advisors, I think we’ve gone way too long allowing Wall Street to tell us what products we should be selling to our clients. We are stewards of our clients’ wealth, and we can turn the tide. I know that I got into this business to help people, and I think this is true for most advisors. I’m not saying that making money isn’t a big part of the equation, but somewhere at the base of being a financial advisor or RIA is a desire to help people achieve their goals.

Incorporating “planet” into “people” and “profit” is important, because obviously if there is no planet left, there will be no people or profits. As RIAs, we control most of the mass affluent wealth in this country, and we can make a huge impact. We can change the world. I truly believe that, and it makes it more exciting to wake up and go to work.

So, I implore all of us to learn more about this new frontier of investing. All of the companies that are here today do an incredible job in helping to educate others, and we are speaking all over the country, with many of these companies, helping to educate advisors and investors on how they can vote with their investor capital.

Gitterman Wealth Management

SMART (

S

ustainability

M

etrics

A

pplied to

R

isk

T

olerance)®

Sustainable, Impact, and ESG Investing Services

for

Individuals

and

Financial Professionals

Gitterman Wealth Management is an industry leader in the Sustainable, Impact, and ESG (Environmental, Social, and Governance) Investing space. For more information about our investing services for individuals, or our research, education, and investing services for financial professionals, please click on the above links, or visit

www.GittermanWealth.com

and click on

Sustainable Investing.