The Partnervest Monthly Global Outlook

The Partnervest Global Outlook

By David Young, chief investment of officer of Partnervest Advisory Services, the portfolio manager of the AdvisorShares STAR Global Buy-Write ETF (Ticker: VEGA)

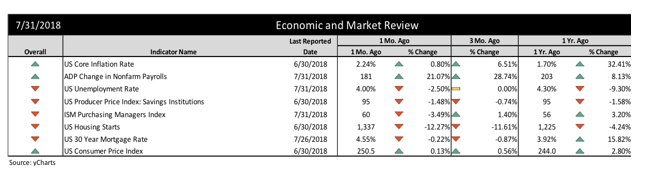

The U.S. economy continued to expand thanks in part to ever-solid payroll growth, a revival of consumer spending, buoyant sentiment surveys and advanced purchases of items marked for tariffs should trade skirmishes assume more destructive escalations. Despite warnings by the International Monetary Fund that a trade war could cost the global economy some $430 billion, U.S. companies continued to report robust earnings reports even as European economies and markets extended their retrenchment. China turned to currency devaluation to warm over its economy as well as to protect its flank should it find itself in a serious confrontation with Washington over trade.

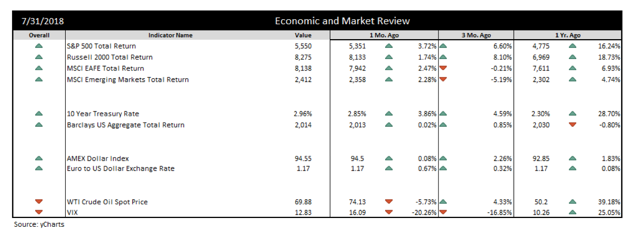

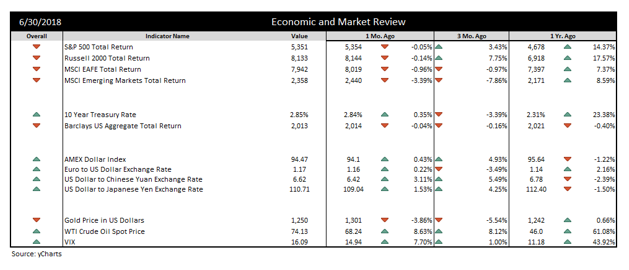

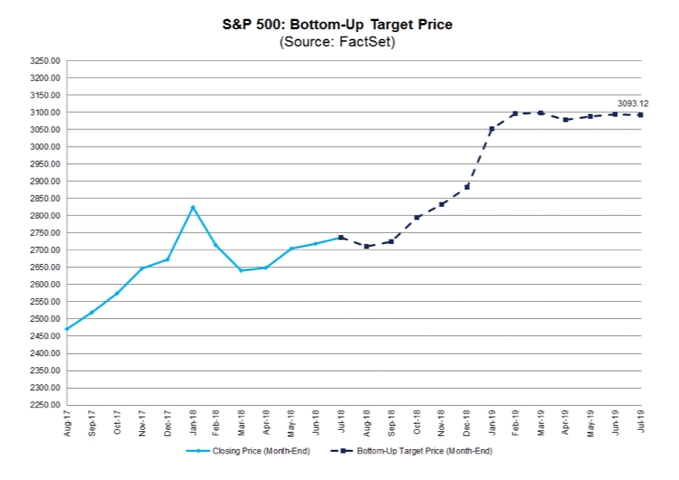

Markets

In the wake of the Fed’s July Federal Open Market Committee meeting, Morgan Stanley anticipated an additional hike in September followed by a pause in December “as policy hits neutral territory and concerns over financial conditions grow.” It also forecast a more hawkish posture next year with three additional hikes in response to low unemployment rate and above-potential GDP. The Fed expressed a bias toward “continued gradually raising the target range for the federal funds rate to a setting … above their estimates of its longer-run level by 2019 or 2020,” according to Morgan Stanley.

The New York and Atlanta Feds reported that its Underlying Inflation Gauge (UIG) is diverging significantly from traditional indexes this year. According to the UIG’s most recent measure, broad inflation came in at a sizzling 3.27%, the highest reading since September 2005. That compares with just 2.8% annual inflation, according to the Labor Department’s CPI, and the more modest 2.0% as measured by the preferred Personal Consumption Expenditure gauge of Fed policy makers.

Stocks held up well in July amid a robust earnings season and despite a rout of tech shares late in the month. FactSet reported that enough S&P companies were poised to log positive EPS to constitute the largest percentage on a quarterly basis since the data house began tracking this metric in Q3 2008. Overall, companies beat robust analyst estimates by an average of 2.5% and nearly three-quarters of listed companies reported sales above estimates. Meanwhile, profit margins among S&P companies for the quarter, at nearly 12.0%, tied net profit margin growth for the previous three-month period, itself the highest net profit margin for the S&P since FactSet began tracking this data in Q3 2008.

A FactSet industry analyst concluded that the S&P 500 would rise by 13.0% in price over the next 12 months – in stark contrast to Guggenheim CIO Scott Minerd’s July 10 Twitter declaration that “Markets are crazy to ignore the risks and consequences of a trade war,” adding “the stock rally is the last hurrah!” His warning followed a similar Cassandra cry by Morgan Stanley strategist Michael Zezas. Asserting that Trump administration standoffs are not bluffs but an expression of policy, Zezas disparaged what he wrote was the opening salvo of “an escalatory cycle of protectionist actions, that shouldn’t be ignored.”

Morgan Stanley forecasts a significant market correction. “The bottom line for us is that we think the selling has just begun and this correction will be the biggest since the one we experienced in February,” the investment bank wrote to clients July 30. The investment bank also predicted the yield curve will invert by the middle of next year, though it stopped short of forecasting a recession, MarketWatch reported.

Investors and policy makers watched with trepidation in mid-June as the Treasury yield curve from 5 to 30 years flattened to levels last seen in August 2007. The New York Times, citing research from the San Francisco Fed, noted that every recession of the past 60 years has been preceded by an inverted yield curve.

Undaunted, Fed officials committed themselves to four interest rate increases in 2018, up one from their March outlook. Investors took it in stride, scooping up some $14 billion worth of 30-month bonds at a yield of 3.10%. As ZeroHedge put it, “Overall, a quick and relatively painless sale in just 48 hours, to a market which despite rising rates, continues to be quite receptive to all the issuance the US government can throw at it.”

According to Bank of America Merrill Lynch however, this may be the calm before the storm. The market, it argued in a note, is still in an orderly “intermediate phase” as interest rates, credit spreads and volatility pivot to reflect a tighter credit environment. “If quantitative easing created an era of lower interest rates, tighter credit spreads and suppressed volatility, the bank warned, quantitative tightening … will lead to the opposite – i.e. higher interest rates, wider credit spreads and very volatile market conditions.” The bank added that global QE has rapidly declined on a year-over-year basis, a trend accelerated by a strong dollar it regards as “destructive to asset values that thrive on liquidity expansion.”

Speaking of trade, The Wall Street Journal implied that U.S. small-cap stocks, having over-performed for months on the strength of perceived insulation from trade tensions, may have peaked. Having sucked up $4 billion in investment capital in May and June, the sector has recently been cited for overstretched valuations and unearthed negative exposure to trade.

Bloomberg noted that the CBOE Skew Index, which tracks the cost of tail-risk equity protection, has jumped to the highest level since October. The rise signals that options traders are growing wary of wild swings, just as the International Monetary Fund warned that financial markets seem complacent to mounting risks in the global economy.

Inspired by a dramatic sell-off of tech stocks led by Facebook, Zero Hedge published the most memorable financial-press headline so far this year: TECH WRECK PUKES $350 BILLION IN 3 DAYS AS FANGOVER BITES.

U.S. Economy

The economy grew at a robust 4.1% rate in the second quarter, the fastest pace in almost four years, while first-quarter growth was revised upward, to 2.2% from 2.0%. Economists cited the continued stimulative impact of tax cuts, as well as forward purchases of goods considered exposed to tariffs in the event of a trade war.

According to the WSJ , U.S. laborers are choosing to leave their jobs at the fastest rate since the internet boom 17 years ago and are getting rewarded for it with higher salaries and/or more satisfying work. The WSJ reported workers have been made more confident by a strong economy and historically low unemployment, currently at 3.8% in May, the lowest since 2000.

Retail sales surged ahead in June, by 0.5%, while sales in May were revised higher to 1.3%, the largest monthly advance since September 2017. In another indicator of buoyant consumption, the Freight Transportation Services Index rose by 6.4%, its third new high in the past four months.

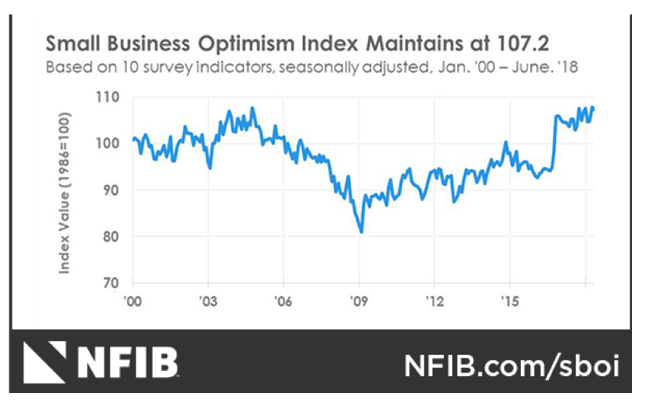

The American Association of Individual Investors weighed in with a widely positive sentiment survey, notching individual investor sentiment up 15% percentage points to 43.1%. The survey results followed the near-record high in the National Federation of Independent Business (NFIB) Small Business Optimism Index as well as the University of Michigan Sentiment Index, which posted a record high among pre-financial crisis readings.

The home-construction market continued to disappoint as the number of new permits in June dropped by 2.2% on a month-to-month and housing starts continued to slide, by 12.3% MoM. It was the 3rd month of declining permits in a row and biggest drop in starts since November 2016 as increasing interest rates impact markets

In a note, Investing Haven suggested that commodity prices are being influenced by a strong dollar – a process that could hasten inflation rates – though it allowed that it may be too early to regard this as a trend. “There are attempts of the USD to break out but there is also rejection at breakout,” according to its research. It is wise to wait for a confirmation of the next trend in the dollar.”

Reuters reported that U.S. loan funds in July posted outflows for the first time in nearly five months. The reversal of some $184 million was attributed to market volatility triggered by tensions in global trade that reduced investors’ appetite for risk assets, Reuters said.

International

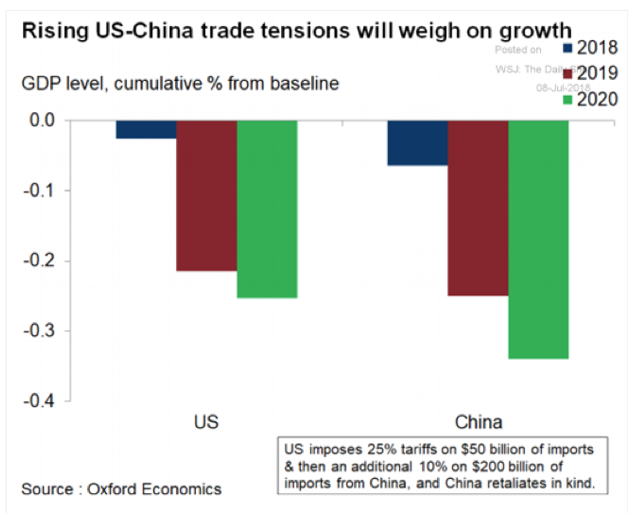

The International Monetary Fund warned that rising trade tensions between the United States and many of its commercial partners could cost the global economy $430 billion with America “especially vulnerable” to an escalating tariff war. The Washington-based organization said the current threats made by the U.S. and its trading partners risked lowering global growth by as much as 0.5% by 2020, or about $430 billion in lost GDP worldwide.

On the data front, European PMIs were mixed, with the flash composite reading for July coming lighter than expected at 54.3. “Although the rate of growth remained relatively robust in July,” Markit noted, “weakened new order inflows and reduced business expectations of future activity added to the downbeat picture.” Meanwhile, retail sales in Europe were unchanged in May at 0.1%, while sales were up 1.4% on a year-over-year basis. According to Eurostat, the highest gains by country were Portugal (+4.7%), Latvia (+3.4%) and Slovenia (3.1%).

In a media call, European Central Banker head Mario Draghi turned sharply dovish, according to Zero Hedge, acknowledging that the European Union headline inflation, now hovering at around 2.0%, may not be sustained. “If you look at inflation excluding oil and food, it’s now 0.9% from 1.1% last time. And the underlying inflation remains muted. So we are seeing encouraging signs here and there [but] it’s very early to call victory.” Both the euro and Bund yields tumbled in response.

Viktor Shvets, head of Asia strategy at Macquarie Commodities and Global Markets, expressed solidarity with troubled emerging markets in the face of the Fed’s Quantitative Easing. Shvets told Bloomberg TV the Fed’s program to reduce its debt stocks “is destroying money, destroying roughly $50 billion every month.” The Fed will ultimately back down, said Shvets, “because the global economy cannot withstand monetary tightening, and will in coming months force a halt to the campaign.”

Cantor Fitzgerald warned of a slide in the Chinese Yuan – “like a sword in the tariff fight” – as it can handily offset the impact of any tariffs imposed. Dismissing market talk China would hold the line at 6.70, Cantor admonished investors to “think back to 2015, when the Yuan was at the center of a storm of global market volatility into early 2016” as a reminder of Beijing’s staying power when it comes to currency depreciation.

The information, statements, views and opinions included in this publication are based on sources (both internal and external sources) considered to be reliable, but not representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Such information, statements, views and opinions are expressed as of the date of publication, are subject to change without further notice and do not constitute a solicitation for the purchase or sale of any investment referenced in the publication.

RSS Import: Original Source