Segall Bryant & Hamill leverages its proprietary investment research, deep industry experience and long‐tenured team to provide intelligently constructed portfolio solutions.

The Return Advantage of High ROIC Investing

With a backdrop that includes Federal Reserve (Fed) rate hikes, near record yield curve inversion, softening economic data, and tightening bank lending standards, we believe companies with high and improving return on invested capital (ROIC) are well positioned to navigate this type of economic and market regime.

Our Small Cap Core investment approach is based on the belief that ROIC and its byproduct, free cash flow, are the most important drivers of long-term outperformance in the small-capitalization universe. Companies with high ROIC generate returns on capital in excess of the cost of capital. These returns indicate the company’s ability to sustain a competitive advantage.

High ROIC During Fed Rate Hike Cycles

Over time, stocks of high ROIC companies have delivered excess relative returns during periods of monetary tightening. Exhibit 1 below highlights how companies with high ROIC levels have performed in the last six Fed rate hike cycles.

High ROIC names (as defined by the top quartile of securities within the Russell 2000 ® Index) have generated alpha relative to the Russell 2000 in five of the six cycles. While acknowledging history may not repeat—and that each of these cycles had its own unique set of circumstances—the relationship between this quality characteristic and returns may prove informative.

Exhibit 1: High ROIC Names Have Generated Alpha in Five of the Past Six Fed Rate Hike Cycles

Performance of High ROIC Companies During Periods of Monetary Tightening

Source: FactSet, Russell, Federal Reserve. Past performance does not guarantee future performance. It is not possible to invest directly in an index. Indexes are unmanaged and do not incur fees and expenses.

High ROIC Outperforms in Periods of Market Stress

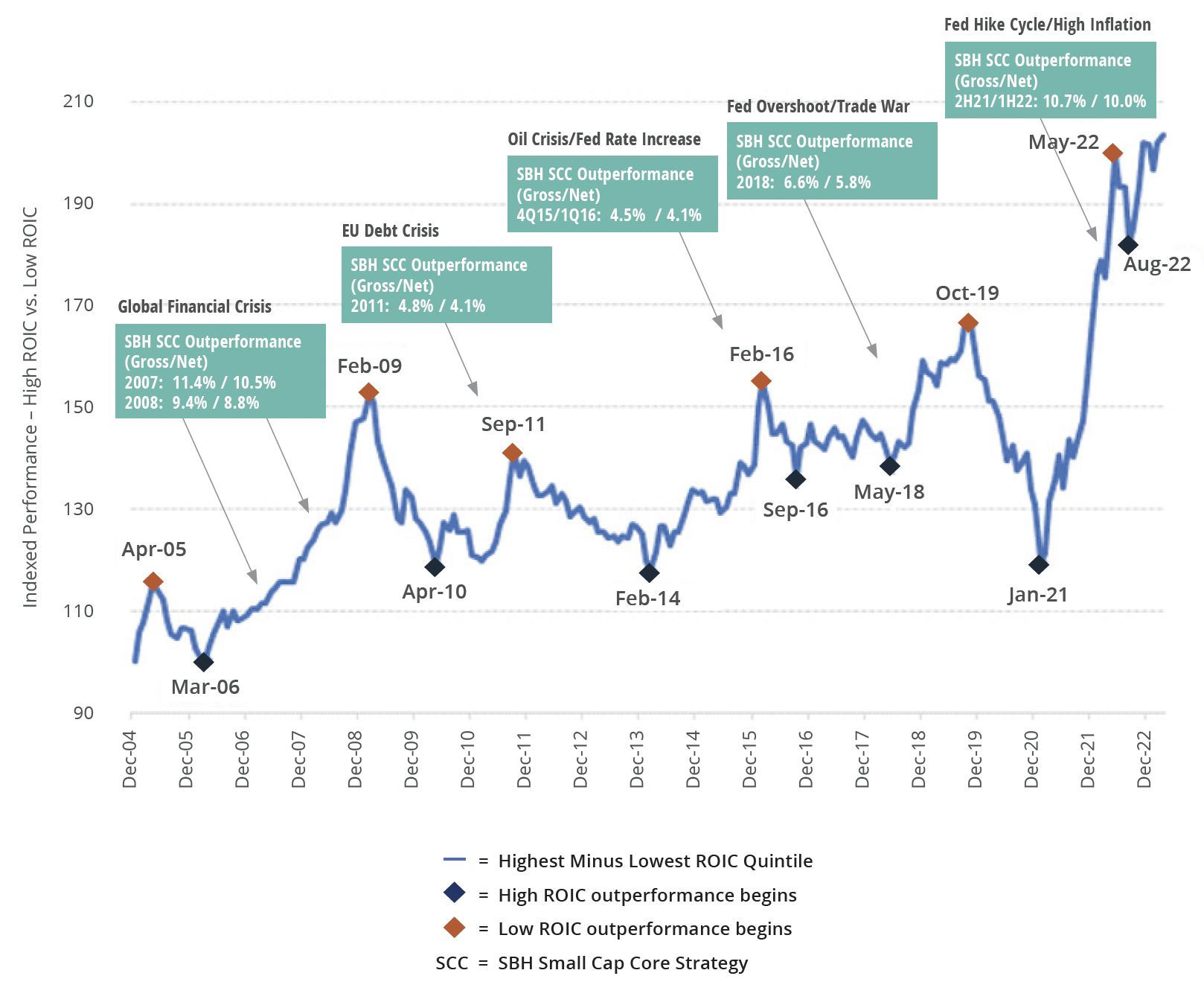

Given the consistent focus on ROIC within the Small Cap Core strategy, we have examined the performance of high ROIC stocks versus low ROIC stocks in market sell-offs dating back to the Global Financial Crisis (GFC). As illustrated in Exhibit 2 , the market consistently prefers (and rotates to) high ROIC companies in times of market stress.

From the GFC (2007-2009) to the more recent Fed hike cycle/high inflation (2H21/1H22), high ROIC companies have outperformed the low ROIC companies relative to the Russell 2000 in nearly every market correction. As such, the Small Cap Core strategy has historically exhibited attractive downside protection in periods of market stress and capital preservation in times of uncertainty.

Exhibit 2: High ROIC Companies Outperform in Periods of Market Stress

Highest Minus Lowest ROIC Quintiles

Data as of 3/31/23. Source: Furey Research Partners and FactSet. Small Cap ROIC quintiles are reconstituted annually and based upon trailing 3-year average ROIC for companies between $200M and $5B market cap. Performance is calculated as a capped average performance for stocks in each quintile. The chart depicts the cumulative difference between the discrete monthly returns for the top minus bottom ROIC quintiles. SBH outperformance is presented gross and net of fees. Past performance cannot guarantee future results. All investments involve risk, including the possible loss of capital. Benchmark is Russell 2000 ® Index. Index performance does not reflect the expenses associated with the management of an actual portfolio or other fees. One cannot invest directly in an index. For illustrative purposes only.

SBH Small Cap Core

A Differentiated Approach to ROIC Small Cap Investing

Our Small Cap Core philosophy is based on four key pillars that, when combined, are designed to generate excess returns. Our experienced small cap equity investment team seeks companies that generate high or improving levels of ROIC, serve niche markets with defendable competitive advantages, are guided by strong management teams, and trade at attractive reward-to-risk ratios.

Our Small Cap Core is available in the following investment vehicles:

– Collective Investment Trust (CIT)

To learn more about SBH Small Cap Core, please reach us at (800) 836-4265 or contactus@sbhic.com.

Segall Bryant & Hamill mutual funds are distributed by Ultimus Fund Distributors, LLC. Separately managed accounts and CITs are not distributed by Ultimus Fund Distributors, LLC.

An investor should consider investment objectives, risks, charges and expenses of the Fund(s) carefully before investing. To obtain the prospectus that contains this and other information about the Fund(s) please call (800) 392-2673 or visit us online at www.sbhfunds.com. Please read the prospectus carefully before investing.

An investment in mutual funds involves risk, including possible loss of principal.

All opinions expressed in this material are solely the opinions of Segall Bryant & Hamill. You should not treat any opinion expressed as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the manager’s opinions. The opinions expressed are based upon information the manager considers reliable, but completeness or accuracy is not warranted, and it should not be relied upon as such. Market conditions are subject to change at any time, and no forecast can be guaranteed. Any and all information perceived from this material does not constitute financial, legal, tax or other professional advice and is not intended as a substitute for consultation with a qualified professional. The manager’s statements and opinions are subject to change without notice,

Loading PDF