Toroso is a registered investment advisor focused on research and asset management using ETFs and other exchange traded products.

Time to look under the hood of your Alternatives

Time to look under the hood of your Alternatives

In last week´s

TETF index

update, we discussed the

Dow Jones Industrial Average (DOW)

hitting all-time highs and FAANG (Facebook, Amazon Apple, Netflix, and Alphabet - formerly Google) stocks continuing to soar. What a difference one week makes! We are halfway into October and volatility has returned. In a time like this, we like to step back and assess the landscape of the tools we have available as portfolio allocators. This week, we’ll focus on the alternative space as both stocks and bonds took a hit in last week’s volatility spike.

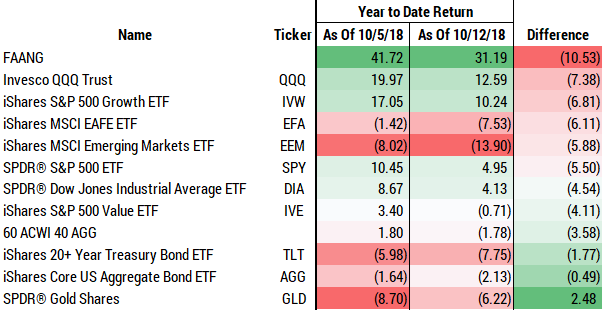

Before we do, let's revisit broad performance of the asset classes covered last week to show how much has truly changed in a short period of time!

Equities were down across the board in correlation with treasuries. The five FAANG stocks have lost 10.53% last week alone. For the purpose of this exercise, we excluded commodity, VIX, leveraged, allocation, and tactical funds; in other words we analyzed those investments built on a more structural diversification approach.

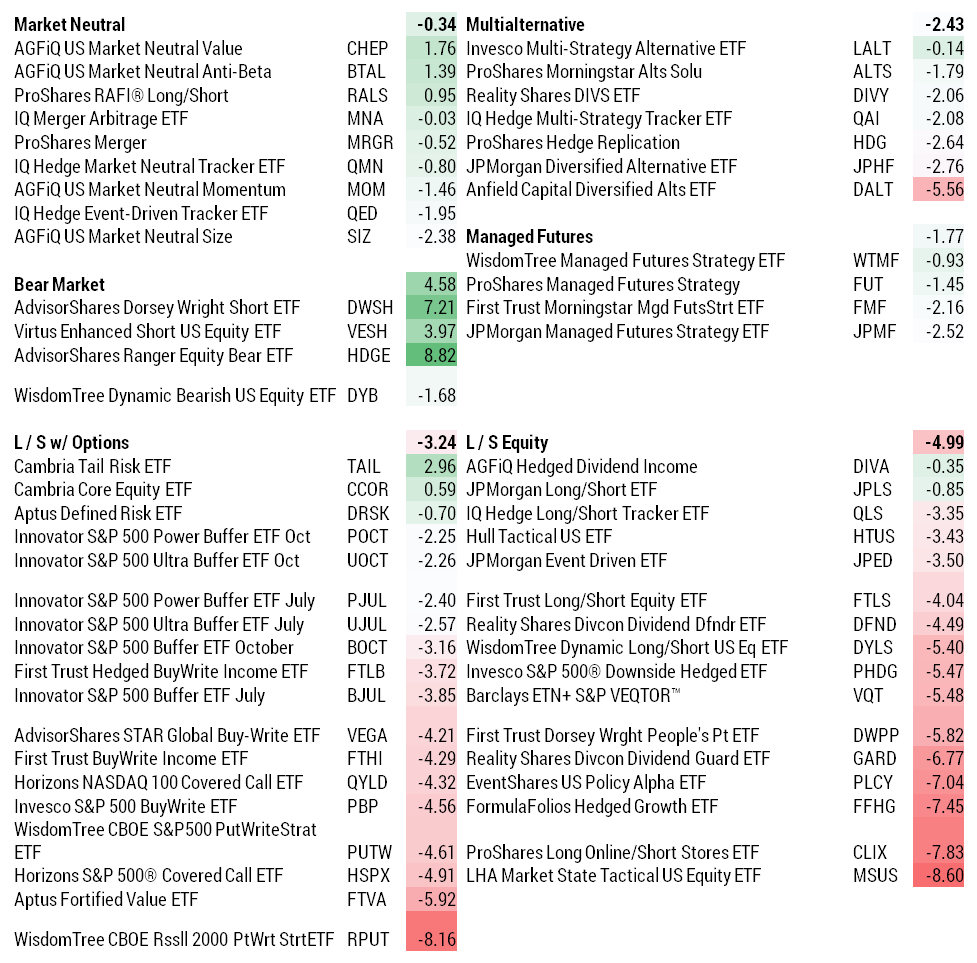

Complete Table of Alternative ETFs Studied with October Performance:

Alternatives of Note:

Based not just on their October performance but more so on their construction, some of our favorite alternatives within this group are:

- Market Neutral: AGFiQ US Market Neutral Anti-Beta BTAL

- Provides exposure to the spread between low and high beta stocks in a market neutral & sector neutral approach. See our original paper on BTAL .

- Long / Short with Options: Cambria Core Equity CCOR

- At least 80% of the fund's value will be invested in equities under normal market conditions, with the remainder in options where pricing provides favorable risk/reward models using call and put option spreads

- Long / Short Equity: JPMorgan Long / Short JPLS

- Long and short exposure to equity factors (value, quality, and momentum) with a dynamic market beta.

Many of these positions have been the unloved child of one’s portfolio, causing pain and reducing overall portfolio returns. T

he last two weeks were a reminder of why alternatives are necessary

in

your portfolio and why digging under the hood is more important than ever!

Understanding these ETFs that go up when the markets go down is another great example of an innovation growth factor for the ETF ecosystem.

Find out more at

www.etfthinktank.com

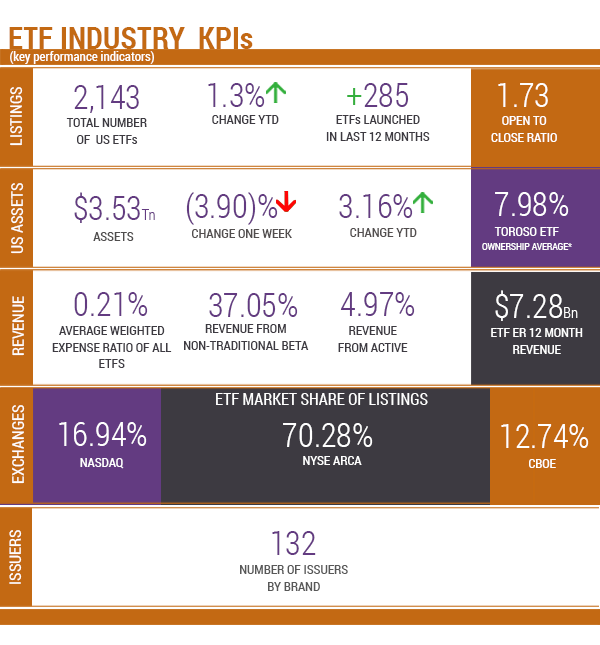

Source of KPIs: Toroso Investments Security Master, as of October 15, 2018

ETF LAUNCHES

Franklin FTSE Latin America ETFFLLA

Franklin FTSE Saudi Arabia ETFFLSA

Columbia Multi-Sector Municipal Inc ETFMUST

Franklin FTSE South Africa ETFFLZA

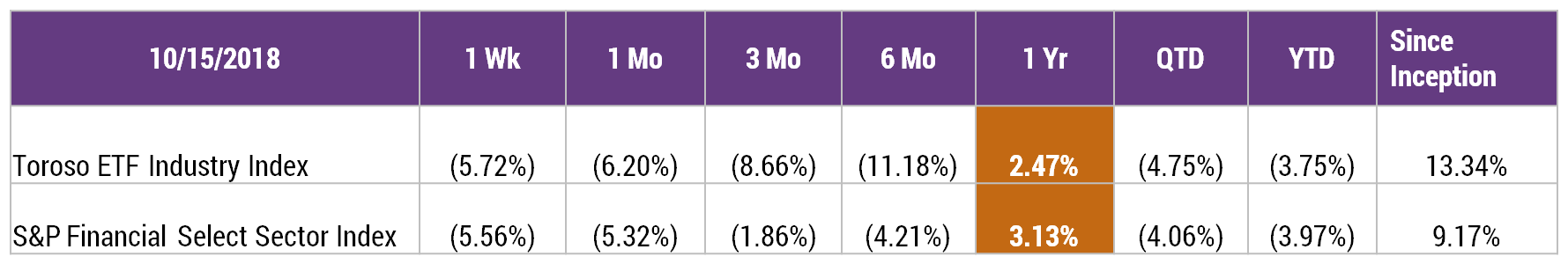

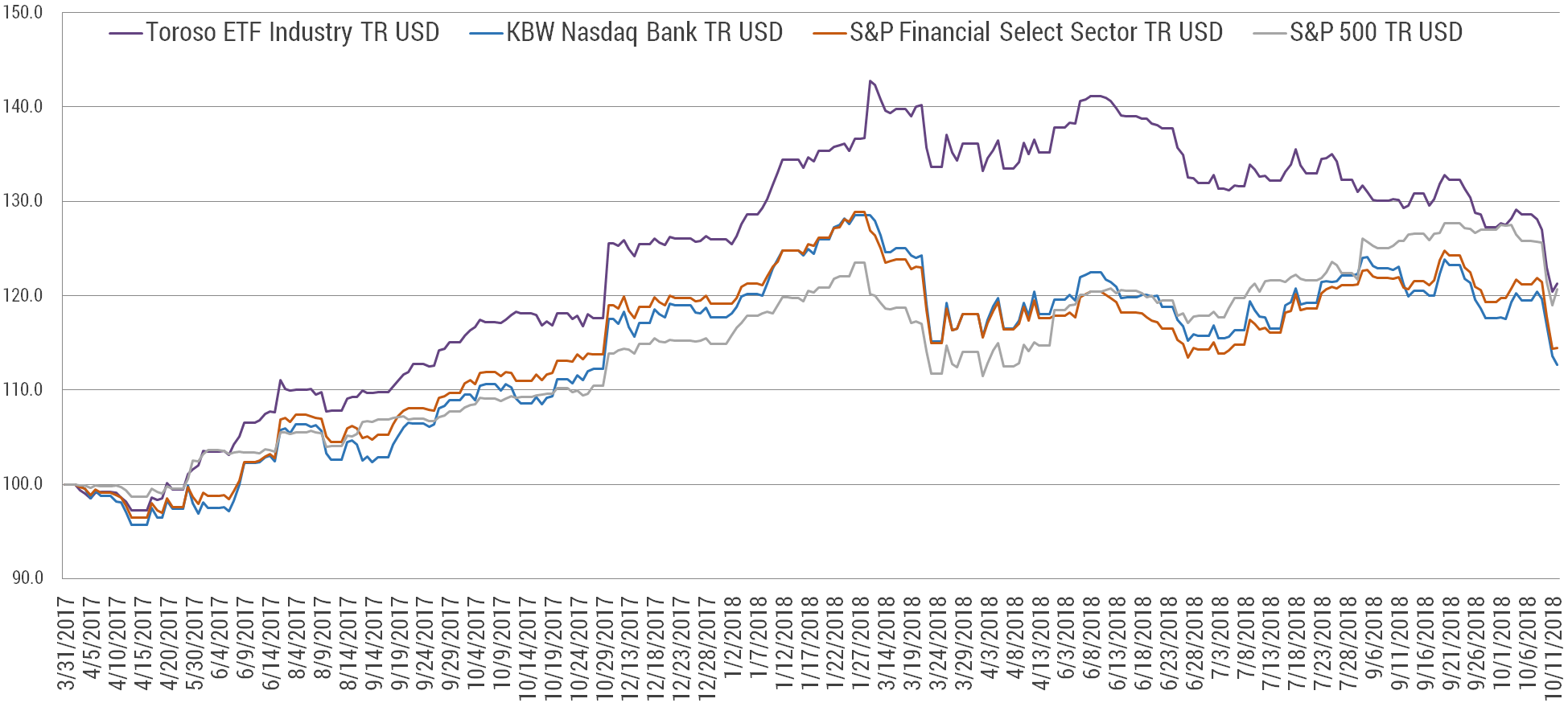

TETF INDEX PERFORMANCE DATA

Returns as of October 15, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

Click here for information on the ETF following TETF Index

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

As of October 15, 2018.

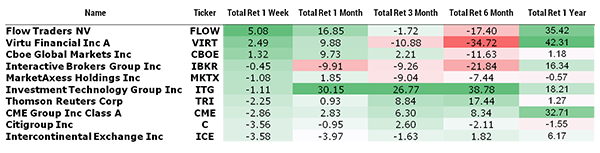

TOP 10 HOLDINGS PERFORMANCE

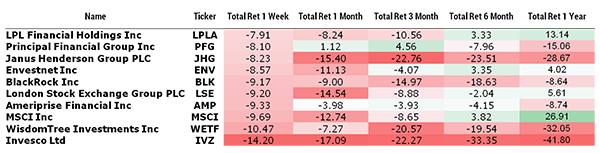

BOTTOM 10 HOLDINGS PERFORMANCE

As of October 15, 2018. Source: Morningstar Direct.

DISCLOSURE: Please see the important Terms & Conditions and the Privacy Policy as they relate to your use of this website.